Exhibit 99.1

September 2019 NASDAQ:AESE

1 DISCLAIMER This presentation is not intended to be all - inclusive or to contain all the information that a person may desire in reviewing the Company, its business or prospects . You are encouraged to review the Company’s periodic reports and other documents filed on the Securities and Exchange Commission’ s website at http://www.sec.gov for more information about the Company, including those Risk Factors set forth in the Company’s Proxy Statement on Schedule 14A filed June 12, 2019 (available at https://www.sec.gov/Archives/edgar/data/1708341/000168316819001882/brac_defm14a.htm ). Neither Allied Esports Entertainment, Inc. (f/k/a Black Ridge Acquisition Corp.) nor any of their respective subsidiaries or affiliates (collectively, the “Company”) makes any representation or warranty as to the accuracy or completeness of the information contained in this presentation . This presentation includes “forward - looking statements.” The Company’s actual results will likely differ from its expectations, estimates and projections and consequently, you should not rely on these forward looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “ cou ld,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward - looking statements. These forward - looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside the Company’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) the outcome of any legal proceedings against the Company ; (2) the ability of the C ompany to grow and manage growth profitably, maintain relationships with suppliers and obtain adequate supply of products and retain its key employees; ( 3 ) general economic conditions and those particularly affecting the industries in which the Company operates; (4) changes in applicable laws or regulations; ( 5 ) the possibility that the C ompany may be adversely affected by other economic, business, and/or competitive factors; and ( 6 ) other risks and uncertainties to be indicated from time to time in the Company’s filings with the Securities and Exchange Commission. T he foregoing list of factors is not exclusive , and r eaders should not place undue reliance upon any forward - looking statements, which speak only as of the date of this presentation . The Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward - looking statements to reflect any change in its expectations or any cha nge in events, conditions or circumstances on which any such statement is based. Some of the financial information and data contained herein is unaudited and does not conform to SEC R egulation S - X. Furthermore, it includes certain financial information (Adjusted EBITDA) not derived in accordance with United States General ly Accepted Accounting Principles (“GAAP”). The Company believe s that the presentation of these non - GAAP measurements provides information that is useful as it indicates more clearly the ability of the Company to meet capital expenditures and working capital requirements and otherwise meet its obligation s as they become due. However, this should not be construed to replace GAAP figures , and such information and data may be adjusted and presented differently in the Company’s filings.

2 Allied Esports Entertainment is a global esports entertainment company powered by two of the largest brands in the rapidly emerging multi - billion dollar competitive entertainment sector — Allied Esports and the World Poker Tour . Allied Esports assists companies wanting to reach the valuable esports audience through the promotion of its own live venue experiences ; generation of world - wide content ; and by providing players a path for engaging directly with global influencers in competitive, high profile live and virtual events that bring together fans and players from around the world . The owner of the industry’s most well - recognized physical esports location, the HyperX Esports Arena Las Vegas in MGM Resort’s Luxor Hotel, the company hosts some of the world’s most compelling esports events as it collaborates with publishers, platforms and high impact influencers . Through strategic investment and commercial agreements with partners like Simon Property Group and TV Azteca , the company aims to provide the infrastructure and comprehensive IP content and operation execution for partners with sufficient resources and highly unique positions which allow them to reach the massive gaming communities (such as media, malls, merchandise and gaming) . These strategic alliances create a powerful ecology for AESE that grows stronger as the model is replicated world wide and additional partners are incorporated . The World Poker Tour has been the leading name in quality, international tournament poker for the past 18 years . Providing inspiration of the three pillar strategy now employed by Allied Esports, the WPT hosts more than 65 poker events worldwide, produces television content reaching more than 200 million people annually and employs various online monetization including its strategic partnership with Zynga , its own ClubWPT products, WPTGO and PlayWPT . The Tour has awarded far in excess of one billion dollars in prize money since its inception . The WPT Champions Cup remains one of the most sought after titles in all of poker and the tour attracts both the most well - known professionals as well as amateurs in the six 6 continents in which it operates . The company attracts high end global sponsors such as Hublot and Baccarat Crystal as it promotes both competition and lifestyle through a valuable targeted database of customers and its talent and brand footprint . ALLIED ESPORTS ENTERTAINMENT

3 ALLIED ESPORTS ENTERTAINMENT OVERVIEW Capitalization Allied Esports Entertainment (“AESE” or the “Company”) became a public company on August 9, 2019 when the merger with Black Ridge Acquisition Corp. closed Company listed on NASDAQ Capital Market (NASDAQ : AESE) Capitalization includes 23.1 million common shares outstanding (1)(2) Business Highlights AESE consists of Allied Esports and the World Poker Tour Strategic investors and partners Simon Property Group and TV Azteca 2019 first half launched original productions PlayTime with KittyPlays , Day One and Nation Vs. Nation 2019 first half HyperX Esports Arena notable hosted events: NBA 2K League, NHL Gaming World Championship and Twitch Prime Crown Cup WPT Season XVII featured more than 60 global events (1) Excludes $50mm in contingent share consideration payable based on achieving a share price of at least $13.00 for 30 consecutive calendar days within five years of transaction close. (2) Excludes 18.6 million warrants and 600,000 underwriter unit purchase options Notable Partners (1) Excludes out of the money warrants and underwriter unit purchase options

4 THE THREE PILLAR SYSTEM In - Person Experiences 1 Multiplatform Content 2 Interactive Services 3 At the heart of AESE’s operating method is a powerful and proven business model — The Three Pillar System . As refined by the World Poker Tour over its 18 - year history and equally applicable to the massive esports community, AESE’s business approach can be summarized as : 1) In - Person Experiences - The creation of engaging live events catered to a dedicated fan and player base 2) Multiplatform Content - T he development of proprietary content that promotes the first pillar while exponentially expanding its customer base 3) Interactive Services - T he monetization of the ecology through online products and services . The result is a business with multiple revenue streams and an enhanced competitive edge as each pillar supports the other and its first mover advantage is further solidified by its brand reinforcement .

5 ALLIED ESPORTS ENTERTAINMENT: NEAR - TERM STRATEGIC FOCUS AESE seeks to establish itself as the leader in a few key dedicated areas of the esports market . Instead of focusing on the development of teams or game publishing, AESE’s focus is to provide the infrastructure to create premier esports entertainment . Recognizing that the key to longer term monetization is the creation of an ecology that keeps its fans and players engaged and provides unique products and services under the Allied banner, the company has developed key relationships in media and encounter - based locations with world - class partnerships that bring a competitive moat to their field . By leveraging the AESE brand, its flagship arenas and fleet of mobile arenas, these assets allow it to offer truly singular offerings to our consumer base . Moreover, one of the advantages of the AESE approach is that instead of being competitive with the major players in other areas of the esports market (such as game publishers and distributors), the company’s instinctive power to mobilize an audience makes it an ideal affiliate fostering even greater collaboration . The recent strong interests of strategic partners has allowed the company to leapfrog over many of the building obstacles originally anticipated and has given the company a more streamline focus which will allow it to achieve its goals faster with less heavy capital outlay . TV Azteca Simon Property Group Owned & Operated Assets

6 PRIMARY BUSINESS FOCUS: OWNED & OPERATED ASSETS At the heart of the AESE network and ecology are its owned and operated assets . Starting with the flagship HyperX Esports Arena , at MGM Resort’s Luxor Hotel, Allied has become the physical symbol of esports for millions of players and fans around the world . More than just a venue, the esports arena was the first 24 / 7 broadcast television studio and competitive arena and spectator encounter center of its kind in the world . As one of the most prominent signs fixed on the Luxor Hotel when one flies into Las Vegas, the Arena has played host to the biggest names in esports and gaming such as Ninja, TSM Myth , FaZe Clan, and Fnatic . The Arena has the ability to host multiple shows and can accommodate more than a 1 , 000 person audience . Publishers such as Riot Games, Capcom and Nintendo have worked with AESE to use the space as well as other collaborations such as t he Allied Esports Rainbow Six Siege Vegas Minor with Ubisoft . Furthermore, the grandeur and efficiencies of having a full working studio have resulted in our successful decision last year to tape all WPT final tables at the HyperX Esports Arena . The arena also allows AESE to create Pillar 2 programming that can be immediately sent to affiliates such as TV Azteca and other regional partners we anticipate in the future, all while promoting the Allied Esports brand and providing high value sponsorship opportunities for companies who wish to reach the esports and gaming demographics . Another unique development of Allied Esports’ property division is its fleet of mobile esports trucks . These massive 18 - wheel semi trucks allow Allied to hold esports events and produce content virtually anywhere in the US or Europe . Extremely popular with partners, they have appeared at the Super Bowl, NASCAR races, music festivals and E 3 . Combined with the HyperX Esports Arena our owned and operated assets provide a comprehensive infrastructure for the development of esports entertainment . Revenues from AESE’s owned and operated assets have seen double digit growth as the popularity of HyperX Esports Arena continues to spread . The sources are Gaming, Sponsorship (such as the Las Vegas arena’s naming rights sponsor HyperX and other brands associating with our pillar 2 content), food and beverage, merchandise and venue rentals . Because the of iconic nature of the facility and AESE’s complimentary business model to other pillars of the esports industry, the facility has been used by most all major publishers and organizations such as the NBA and National Hockey League . Similarly the rental of the mobile arenas have continued to increase significantly . While these revenues are important to our business, each work to reinforce and enhance the Allied brands, which in turn creates a more sticky ecology for the lifetime value of our long term customers . LEAGUE OF LEGENDS ALL STARS 2018 CAPCOM CUP 2018 & 2019 NHL WORLD GAMING CHAMPIONSHIP 2018 & 2019 NBA2K: THE TURN 2019 NINJA VEGAS ‘18 PLAYTIME WITH KITTYPLAYS

7 NEAR TERM EXECUTION: OWNED & OPERATED ASSETS AESE will continue to organize and host the most engaging esports events in Las Vegas in order to grow business to consumer revenue streams and leverage our prominent position as the world’s premier esports venue to continue to attract the most high profile esports events and productions. HyperX Esports Arena Las Vegas AESE will increase the frequency by which we deploy and monetize our truck assets by targeting industries beyond gaming and esports including music festivals and sporting events. HyperX Esports Trucks

8 SIMON PROPERTIES: STRATEGIC INVESTOR AESE seeks to be the undisputed industry leader in the current trend of migration of malls into experiential centers as related to gaming and esports . In one of its first major partnerships, AESE has announced it has partnered with Simon Property Group, a leading mall operator . In addition to being one of AESE’S largest corporate shareholders, Simon has entered into a commercial agreement with AESE to develop a two pronged approach consisting of dedicated on - mall esports venues and a series of consistent tournaments and on - mall festivals at Simon malls and in conjunction with AESE’s fleet of mobile esports trucks . This Pillar One focus will capitalize on mall traffic as well as AESE’s ability to drive consumers to permanent physical themed locations with already - ideal infrastructure for gathering for esports play . Like the flagship venues, revenues come from gaming, rentals, merchandise and food & beverage . However, because of the size and premier location of the venues sponsorship revenues are also possible by licensing title right to theme - games (which promotes publisher IP) as well as traditional sponsorship . AESE will retain 100 % of revenues in exchange for a reduced lease operation within the malls . Having permanent venues and a captured market of foot traffic and retail sales partner network, the partnership allows AESE to also create specialized, localized and proprietary IP such as the first of its kind Simon Cup — a seasonal tournament series that engages the regional markets through high profile competitive achievement and gaming festivals while combining incentives that pull from the vast retail network of Simon’s mall tenants . The Simon Cup combines the full power of AESE’s ability to create compelling IP and mobilize its esport consumer base, with the power of an infrastructure that only the largest mall chains in America can provide . Regularly scheduled tournaments are promoted throughout the malls and are played online to capture the largest regional audience playing down to one of several Simon playoff locations and utilizing AESE’s fleet of mobile esports trucks . Compelling content is created not only from the game play and festival footage but from ancillary events such as the winner’s timed shopping spree at Simon locations . As a tenant of Pillar Two, the content around these prestigious esports events serves to promote the tournaments and greatly expand the reach of the consumer base . Revenues are made from Pillar One onsite activities, Pillar Two sponsorships and Pillar Three online tournament fees and other Pillar three monetization methods . These revenues operate on a revenue share basis with Simon Property Group .

9 NEAR TERM EXECUTION: MALL EXPERIENCE On - Mall Venues AESE’s property team is in the final site selection process for Simon and Allied’s first on - mall esports venue . The locations will be targeting 8 - 10 , 000 square feet of space located in entertainment areas at high traffic malls with offerings that align with our core customer . Key to AESE’s ability to leverage the infrastructure we plan for these venues is the use of mall common areas for larger events that AESE produces for pillar 2 content or for publisher and partner rentals . We plan to open our first on - mall venue in 2020 . Simon Cup AESE’s first Simon Cup season will kick off this fall with online and on - mall qualifiers leading to a Las Vegas Final and Grand Prize $ 50 , 000 Simon Mall Shopping Spree . AESE will deploy an influencer - based marketing campaign as well as an on - mall marketing campaign in 13 regionally relevant malls as AESE builds toward the on - mall gaming and esports festivals . Following the successful completion of Season 1 AESE plans to launch a further expanded Season 2 that will take place in more properties across the U . S .

1 0 TV AZTECA: STRATEGIC INVESTOR A large scale media partner creates a powerful competitive advantage in accelerating the Three Pillar model . As a shareholder and commercial partner, TV Azteca provides unmatched strategic advantage in Latin America – one of the fastest growing markets in esports – and in the joint rollout of a 24 / 7 digital esports channel . Under AESE’s agreement with TV Azteca, the companies will develop a 24 / 7 dedicated digital esports channel to broadcast original, co - produced, and licensed programming that will consist of live events, episodic content, and archived segments, as well as news and cross - over content . The channel will provide a hub for players under the combined brands of Allied and TV Azteca, and the companies have already begun to build an esports audience through successful co - produced programming . The digital esports channel, developed over the next 24 months, will provide an important platform for the production, co - production, and content aggregation efforts that will provide the basis for programmatic revenues from ads, sponsorships and distribution of shows individually and in blocks . The unparalleled effect of TV Azteca’s market power is exemplified also by the launch of localized programming of the World Poker Tour televisions series in the market on its free - to - air Channel 7 . Since the initial airings in August 2019 , WPT has already seen a record 3 million people tuning - in to watch a single episode before full marketing, repeat and repeat airing have been scheduled . Utilizing well - known regional talent commentating in Spanish on the US broadcast taped shows, the show is being used to promote the WPTGO online social gaming platform launched in Beta in August . With full scale marketing planned for the fall, this will typify our Third Pillar strategy of monetization online and vastly will improve the scalability and reach of the WPT in the vast Spanish language market . Revenue streams from AESE’s TV Azteca strategic alliance include, Pillar One in - person revenues, fees, merchandise and sponsorship (the latter greatly enhanced by the ability of the company to promote sponsors on a holistic and wide - ranging basis) ; Pillar Two sponsorship and ad fees from television and streaming content ; and Pillar Three subscription revenues, publisher affiliate fees, sponsorship on both the digital platform and WPTGO . All fees related to content and digital channel are on a revenue share basis with TV Azteca . DIGITAL CHANNEL & CONTENT TV Azteca is the # 1 sports network in Latin America and # 2 global provider of Spanish - language content . TV Azteca’s massive broadcast television footprint, bundled cable services, sporting arenas, and Electra stores provide a very structured avenue for Allied Esports to gain scalability quickly in the Latin America market .

11 LOOKING TO THE FUTURE: INTERACTIVE PLATFORM Allied Esports intends to develop its own online platform where esports players and fans can watch, play and win with other members of the esports community and top esports personalities . The online platform will enable fans to compete against each other as well as participate in esports programs starring their favorite players . Subscriptions will provide members with exclusive access to numerous unique and proprietary experiences, products and services that are not available outside of Allied Esports’ ecosystem, such as exclusive online content, member - only tournaments, prizes and cash awards, exclusive live event and merchandise access, exclusive opportunities to be part of our entertainment programming, VIP treatment at Allied Esports’ arenas, and much more . As described above, Allied Esports intends to use the authenticity and reach driven by its in - person experiences and content viewership to drive platform adoption by esports fans . Allied Esports Entertainment’s executive team has years of experience developing online platforms — its CEO, Frank Ng, has managed and run online platforms with approximately 700 million registered users in China for over 14 years, and its COO, David Moon, has produced, published and operated numerous game services for over 20 years, including helping build NHN Corporation’s global footprint to over 1 million concurrent users . Furthermore, WPT has developed and operated its subscription platform for poker fans, ClubWPT , since 2010 , and developed and operated a social poker product, PlayWPT , starting in 2016 . Allied Esports will sequentially roll out platform features to support core strategic initiatives with its strategic partners, Simon and TV Azteca . The initial release of the platform will focus on supporting regular programs of esports experiences across Simon’s national network of premier mall destinations . The platform will subsequently be released in Mexico in partnership with TV Azteca, to support the participation, viewing, and monetization of esports events and programs, as well as the provision of a 24 / 7 digital esports entertainment channel .

12 The WPT 3 Pillar model starts with over 65 events around the world of various buy - in levels . From high roller events to charity events such as Tiger’s Poker Night (benefits the Tiger Woods Foundation), the events serve WPT’s most ardent fans and provide a competitive platform for players seeking to compete at the highest levels, including securing their name on one of the most coveted titles in poker – The WPT Champions Cup . The WPT has played an instrumental role in the emergence of AESE . From its long standing relationship with MGM, resulting in the launch of HyperX Esports Arena Las Vegas, to its experience in production and distribution, and even its broadcasting of the final tables of the WPT at the HyperX Esports Arena, the companies have been great compliments and have allowed Allied to avoid costly pitfalls as it deploys its model . From the many events, WPT creates and distributes hundreds of hours of footage yearly on Fox Sports Net in the US, Channel 7 on TV Azteca in Latin America, and over two dozen broadcasters, reaching more than 200 Million people annually . The show has also proven immensely popular on a number of well distributed online channels . The result of this is a best - in - class brand position that attracts not only the world’s greatest players but also world class sponsors . Such a prolific broadcast footprint allows WPT to deploy a successful Pillar Three online monetization strategy that now accounts for nearly 2 / 3 of its revenues . Subscription gaming such as ClubWPT , social gaming such as Zynga and PlayWPT and regional online gaming such as WPTGo provide a model that allows WPT’s customers to stay in continual contact . And as WPT continues to grow internationally, the ability to deploy its model on a regional basis is a strong tool in gaining scalability . WORLD POKER TOUR WPT Global Footprint

13 WPT NEAR TERM EXECUTION: INTERACTIVE SERVICES ZYNGA POKER 1 2 3 4 CLUBWPT WPTGO PLAYWPT Online games offer a way for WPT’s customer to stay connected throughout the world 24 hours a day . By leveraging its database, extensive 18 - year - old television library of footage and its global distribution footprint social gaming becomes a primary driver of the WPT business . WPT’s primary partnership with massive social gaming giant, Zynga Poker, allows its audience to experience WPT competition in a causal environment . Zynga players also enjoyed special invitations to WPT events in Las Vegas where they have competed against some of the largest names in poker . And WPT has additional offerings, such as ClubWPT . com which offers poker, slots and valuable benefits in addition to real prizes like entrees to WPT events, invitations to the WPT cruise and other in - person talent experiences . In Latin America, WPT has just launched WPTGO in conjunction with its strategic investment partner, TV Azteca . This poker and social casino site is bolstered by the committed distribution of the WPT television show using notable Latin American talent on Channel 7 — one of the primary free - to - air stations in Mexico . Other offerings include PlayWPT and soon to be launched, WPTAlpha 8 , for the asian market which also cater to the high demand for quality online poker experiences that incorporate the WPT brand . WPT is currently evaluating opportunities to its sports book affiliate strategy as well as real money gaming poker, both which have the potential to be primary revenue drivers of the business in the years to come .

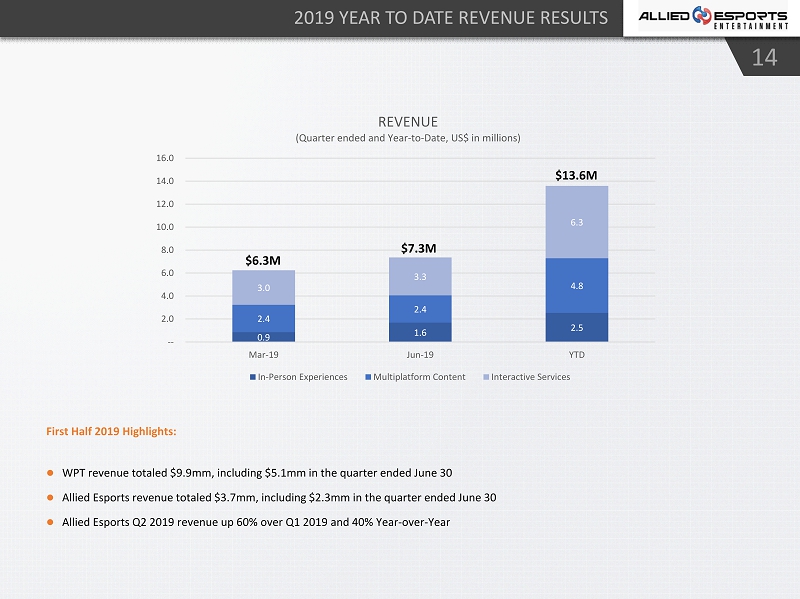

14 2019 YEAR TO DATE REVENUE RESULTS 0.9 1.6 2.5 2.4 2.4 4.8 3.0 3.3 6.3 -- 2.0 4.0 6.0 8.0 10.0 12.0 14.0 16.0 Mar-19 Jun-19 YTD REVENUE (Quarter ended and Year - to - Date, US$ in millions) In-Person Experiences Multiplatform Content Interactive Services First Half 2019 Highlights: WPT revenue totaled $9.9mm, including $5.1mm in the quarter ended June 30 Allied Esports revenue totaled $3.7mm, including $2.3mm in the quarter ended June 30 Allied Esports Q2 2019 revenue up 60% over Q1 2019 and 40% Year - over - Year $6.3M $7.3M $13.6M

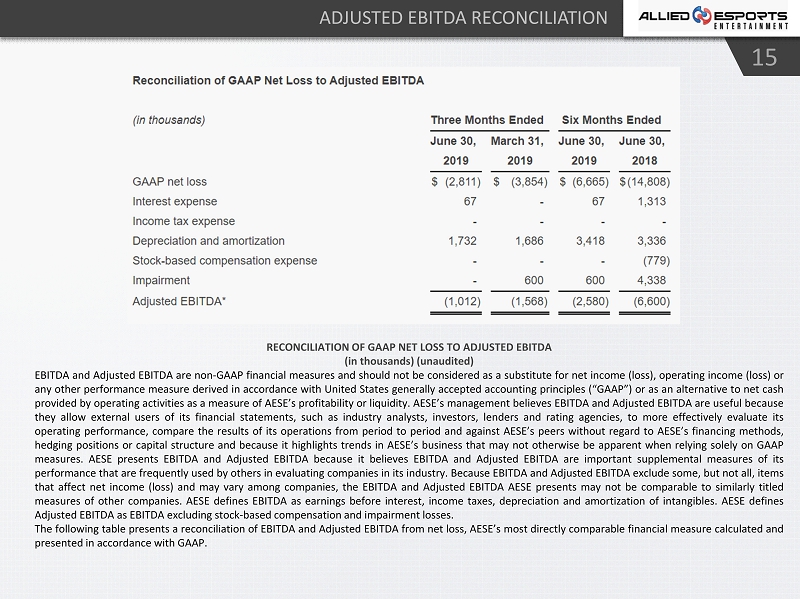

15 ADJUSTED EBITDA RECONCILIATION RECONCILIATION OF GAAP NET LOSS TO ADJUSTED EBITDA (in thousands) (unaudited) EBITDA and Adjusted EBITDA are non - GAAP financial measures and should not be considered as a substitute for net income (loss), operating income (loss) or any other performance measure derived in accordance with United States generally accepted accounting principles (“GAAP”) or as an alternative to net cash provided by operating activities as a measure of AESE’s profitability or liquidity . AESE’s management believes EBITDA and Adjusted EBITDA are useful because they allow external users of its financial statements, such as industry analysts, investors, lenders and rating agencies, to more effectively evaluate its operating performance, compare the results of its operations from period to period and against AESE’s peers without regard to AESE’s financing methods, hedging positions or capital structure and because it highlights trends in AESE’s business that may not otherwise be apparent when relying solely on GAAP measures . AESE presents EBITDA and Adjusted EBITDA because it believes EBITDA and Adjusted EBITDA are important supplemental measures of its performance that are frequently used by others in evaluating companies in its industry . Because EBITDA and Adjusted EBITDA exclude some, but not all, items that affect net income (loss) and may vary among companies, the EBITDA and Adjusted EBITDA AESE presents may not be comparable to similarly titled measures of other companies . AESE defines EBITDA as earnings before interest, income taxes, depreciation and amortization of intangibles . AESE defines Adjusted EBITDA as EBITDA excluding stock - based compensation and impairment losses . The following table presents a reconciliation of EBITDA and Adjusted EBITDA from net loss, AESE’s most directly comparable financial measure calculated and presented in accordance with GAAP .

APPENDIX

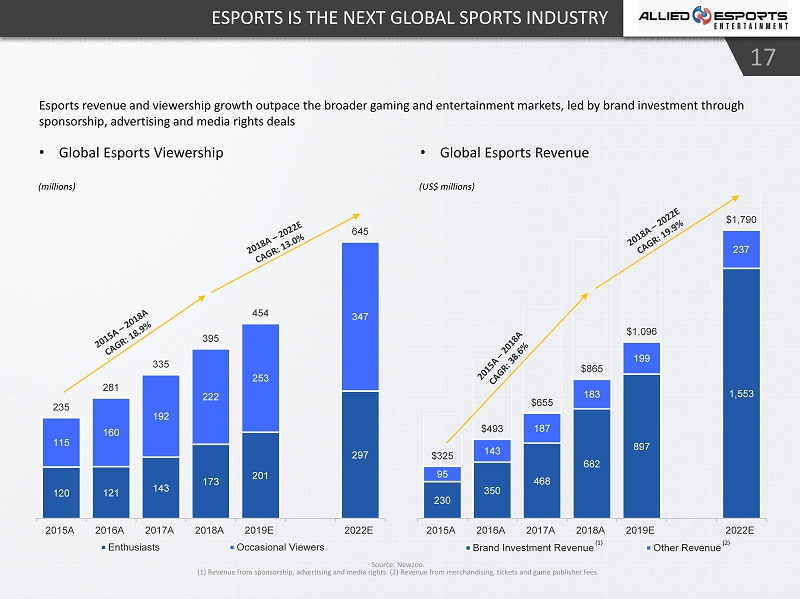

17 ESPORTS IS THE NEXT GLOBAL SPORTS INDUSTRY 230 350 468 682 897 1,553 95 143 187 183 199 237 $325 $493 $655 $865 $1,096 $1,790 2015A 2016A 2017A 2018A 2019E 2022E Brand Investment Revenue Other Revenue 120 121 143 173 201 297 115 160 192 222 253 347 235 281 335 395 454 645 2015A 2016A 2017A 2018A 2019E 2022E Enthusiasts Occasional Viewers Esports revenue and viewership growth outpace the broader gaming and entertainment markets, led by brand investment through sponsorship, advertising and media rights deals Source: Newzoo. (1) Revenue from sponsorship, advertising and media rights. (2) Revenue from merchandising, tickets and game publisher fees. • Global Esports Viewership • Global Esports Revenue (US$ millions) (millions) (2) (1)

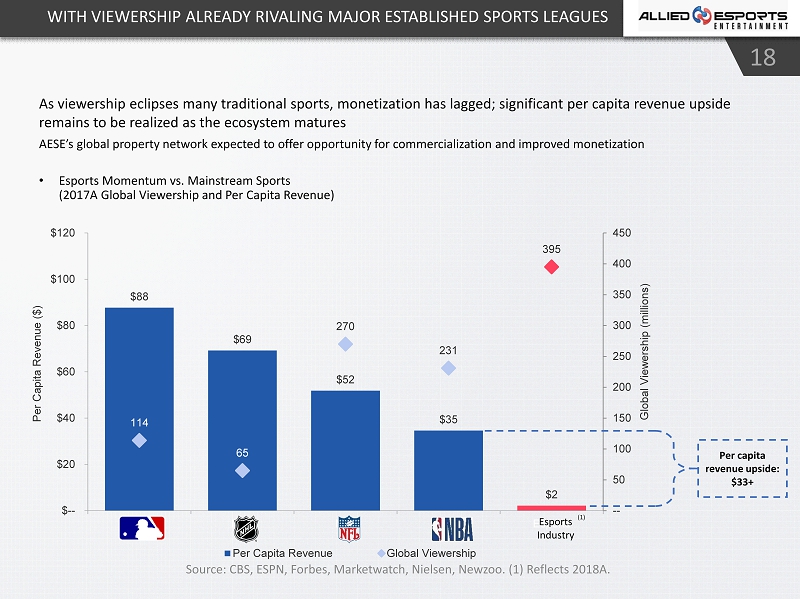

18 WITH VIEWERSHIP ALREADY RIVALING MAJOR ESTABLISHED SPORTS LEAGUES $88 $69 $52 $35 $2 114 65 270 231 395 -- 50 100 150 200 250 300 350 400 450 $-- $20 $40 $60 $80 $100 $120 MLB NHL NFL NBA Esports Global Viewership (millions) Per Capita Revenue ($) Per Capita Revenue Global Viewership As viewership eclipses many traditional sports, monetization has lagged; significant per capita revenue upside remains to be realized as the ecosystem matures AESE’s global property network expected to offer opportunity for commercialization and improved monetization Source: CBS, ESPN, Forbes, Marketwatch, Nielsen, Newzoo. (1) Reflects 2018A. • Esports Momentum vs. Mainstream Sports (2017A Global Viewership and Per Capita Revenue) Per capita revenue upside: $33+ Esports Industry (1)