Exhibit 99.2

© 2019 ALLIED ESPORTS ENTERTAINMENT, INC. Allied Esports Entertainment ROTH Conference March 2019

PAGE 1 © 2019 ALLIED ESPORTS ENTERTAINMENT, INC. Disclaimer Neither Black Ridge Acquisition Corp. (“Black Ridge”), AEI/WPT LLC (“AEI/WPT”) nor any of their respective affiliates makes a ny representation or warranty as to the accuracy or completeness of the information contained in this presentation. The sole purpose of the presentation is to assist persons in deciding whether the y w ish to proceed with a further review of the proposed transaction discussed herein and is not intended to be all - inclusive or to contain all the information that a person may desire in considering the proposed t ransaction discussed herein. It is not intended to form the basis of any investment decision or any other decision in respect of the proposed transaction. This presentation shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed transactions. This presentation shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Macquarie Capital (USA) Inc. (“Macquarie”) has been engaged to assist Black Ridge in connection with its proposed business co mbi nation, for which it will receive a fee. EarlyBirdCapital, Inc. (“EBC”), the sole book - running managing underwriter of Black Ridge’s initial public offering consummated in October 2017, has also been engaged to assist Black Ridge in connection with the transaction, for which it will receive a fee. Black Ridge and its directors and executive officers and Macquarie and EBC may be deemed to be participants in the solicitati on of proxies for the special meeting of Black Ridge shareholders to be held to approve the proposed business combination (“meeting”). Shareholders of Black Ridge and other interested persons are advised to read, when available, Black Ridge’s preliminary proxy statement and definitive proxy statement in connection with Black Ridge’s solicitation of proxies for the meeting because these documents will contain im portant information. Such persons can also read Black Ridge’s final prospectus, dated October 4, 2017, for a description of the security holdings of Black Ridge’s officers and directors and of their respec tiv e interests as security holders in the successful consummation of the proposed business combination. The definitive proxy statement will be mailed to shareholders of Black Ridge as of a record date to be es tablished for voting on the proposed business combination. Shareholders will also be able to obtain a copy of such document, without charge, by directing a request to: Black Ridge Acquisition Corp., c/o Bla ck Ridge Oil & Gas, Inc., 110 North 5th Street, Suite 410, Minneapolis, MN 55403. These documents, once available, and Black Ridge’s IPO final prospectus can also be obtained, without charge, at the securiti es and exchange commission's internet site (http://www.sec.gov). This presentation includes “forward - looking statements.” Black Ridge’s and AEI/WPT’s actual results may differ from its expectat ions, estimates and projections and consequently, you should not rely on these forward looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecas t,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward - looking statements. These forward - looking statements include, without limitation, Black Ridge’s and AEI/WPT’s expectations with respect to future performance and anticipated financial impacts of the proposed transaction, the satisfaction of the clo sin g conditions to the proposed transaction, and the timing of the completion of the proposed transaction. These forward - looking statements involve significant risks and uncertainties that could cause the actual results to differ mater ially from the expected results. Most of these factors are outside Black Ridge’s and AEI/WPT’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) the outcome of any legal proceedings against AEI/WPT or Black Ridge; (2) the inability to complete the business combination, including due to failure to obtain approval of the shareholders of Black Ridge or other co ndi tions to closing; (3) delays in obtaining, adverse conditions contained in, or the inability to obtain necessary regulatory approvals or complete regulator reviews required to complete the business combinatio n; (4) the risk that the proposed transaction disrupts current plans and operations as a result of the announcement and consummation of the transaction described therein and herein; (6) the ability to recognize t he anticipated benefits of the business combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relations hip s with suppliers and obtain adequate supply of products and retain its key employees; (7) costs related to the proposed business combination; (8) changes in applicable laws or regulations; (9) the pos sib ility that the combined company may be adversely affected by other economic, business, and/or competitive factors; and (10) other risks and uncertainties to be indicated from time to time in Black Ridge ’s filings with the Securities and Exchange Commission. Black Ridge cautions that the foregoing list of factors is not exclusive. Black Ridge cautions readers not to place undue rel ian ce upon any forward - looking statements, which speak only as of the date made. Black Ridge does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any fo rwa rd - looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Some of AEI/WPT’s financial information and data contained herein is unaudited and does not conform to SEC regulation S - X. Furth ermore, it includes certain financial information (EBITDA) not derived in accordance with United States Generally Accepted Accounting Principles (“GAAP”). Accordingly, such information and data will be adjusted and presented differently in Black Ridge’s proxy statement to solicit shareholder approval of the proposed transaction. Black Ridge and AEI/WPT believe that the presentation of non - GAAP measurement s provides information that is useful to investors as it indicates more clearly the ability of AEI/WPT to meet capital expenditures and working capital requirements and otherwise meet its obligation as the y b ecome due. However, this should not be construed to replace GAAP figures.

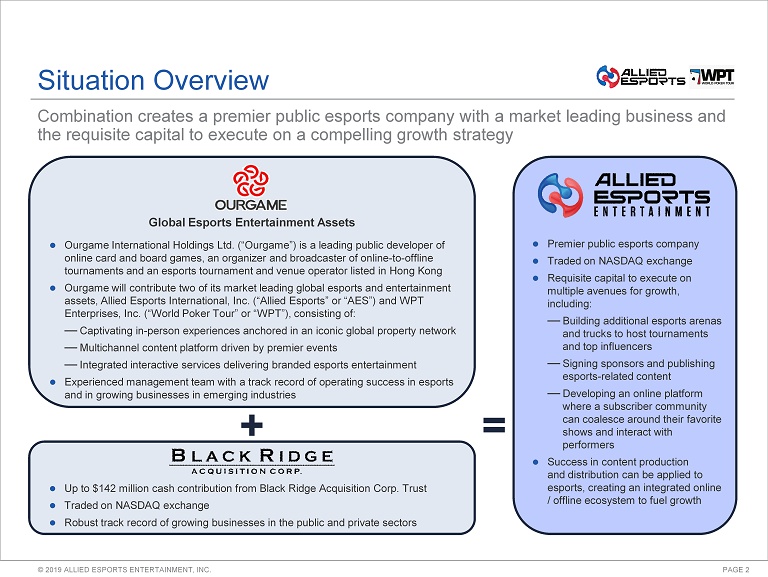

PAGE 2 © 2019 ALLIED ESPORTS ENTERTAINMENT, INC. • Premier public esports company • Traded on NASDAQ exchange • Requisite capital to execute on multiple avenues for growth, including: — Building additional esports arenas and trucks to host tournaments and top influencers — Signing sponsors and publishing esports - related content — Developing an online platform where a subscriber community can coalesce around their favorite shows and interact with performers • Success in content production and distribution can be applied to esports, creating an integrated online / offline ecosystem to fuel growth • Up to $ 142 million cash contribution from Black Ridge Acquisition Corp. Trust • Traded on NASDAQ exchange • Robust track record of growing businesses in the public and private sectors Situation Overview + = Combination creates a premier public esports company with a market leading business and the requisite capital to execute on a compelling growth strategy • Ourgame International Holdings Ltd. (“Ourgame”) is a leading public developer of online card and board games, an organizer and broadcaster of online - to - offline tournaments and an esports tournament and venue operator listed in Hong Kong • Ourgame will contribute two of its market leading global esports and entertainment assets, Allied Esports International, Inc. (“Allied Esports” or “AES”) and WPT Enterprises, Inc. (“World Poker Tour” or “WPT”), consisting of: — Captivating in - person experiences anchored in an iconic global property network — Multichannel content platform driven by premier events — Integrated interactive services delivering branded esports entertainment • Experienced management team with a track record of operating success in esports and in growing businesses in emerging industries Global Esports Entertainment Assets .

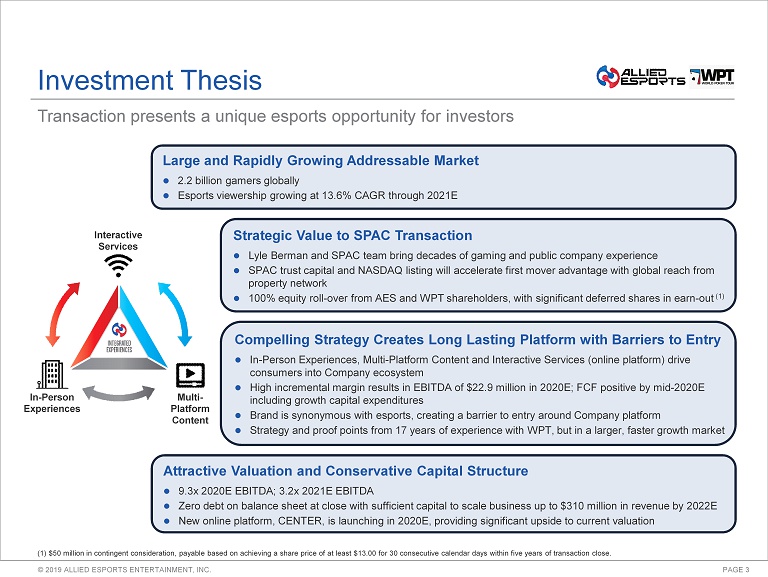

PAGE 3 © 2019 ALLIED ESPORTS ENTERTAINMENT, INC. Transaction presents a unique esports opportunity for investors (1) $50 million in contingent consideration, payable based on achieving a share price of at least $13.00 for 30 consecutive c ale ndar days within five years of transaction close. Investment Thesis Large and Rapidly Growing Addressable Market • 2.2 billion gamers globally • Esports viewership growing at 13.6% CAGR through 2021E Strategic Value to SPAC Transaction • Lyle Berman and SPAC team bring decades of gaming and public company experience • SPAC trust capital and NASDAQ listing will accelerate first mover advantage with global reach from property network • 100% equity roll - over from AES and WPT shareholders, with significant deferred shares in earn - out (1) Compelling S trategy Creates Long Lasting Platform with Barriers to Entry • In - Person Experiences, Multi - Platform Content and Interactive Services (online platform) drive consumers into Company ecosystem • High incremental margin results in EBITDA of $22.9 million in 2020E; FCF positive by mid - 2020E including growth capital expenditures • Brand is synonymous with esports , creating a barrier to entry around Company platform • Strategy and proof points from 17 years of experience with WPT, but in a larger, faster growth market Attractive Valuation and Conservative Capital Structure • 9.3x 2020E EBITDA; 3.2x 2021E EBITDA • Zero debt on balance sheet at close with sufficient capital to scale business up to $310 million in revenue by 2022E • New online platform, CENTER, is launching in 2020E, providing significant upside to current valuation In - Person Experiences Multi - Platform Content Interactive Services

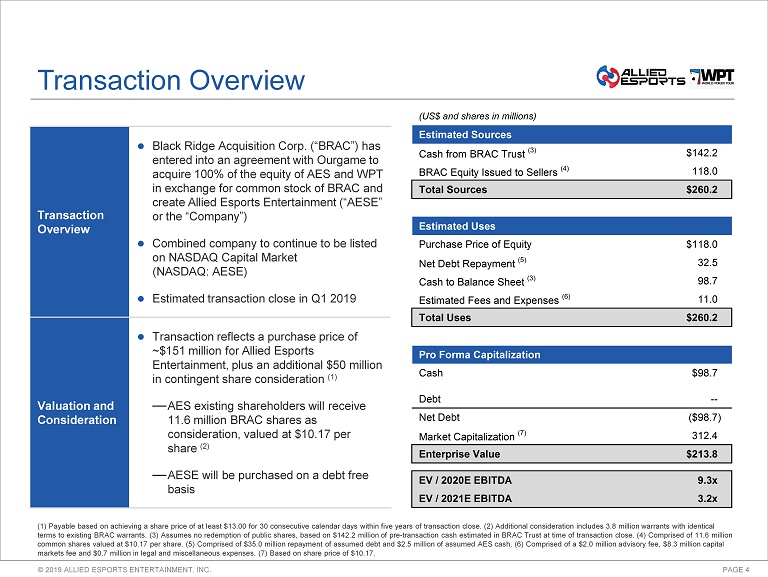

PAGE 4 © 2019 ALLIED ESPORTS ENTERTAINMENT, INC. Pro Forma Capitalization Cash $98.7 Debt -- Net Debt ($98.7) Market Capitalization (7) 312.4 Enterprise Value $213.8 EV / 2020E EBITDA 9.3x EV / 2021E EBITDA 3.2x (US$ and shares in millions) Estimated Sources Cash from BRAC Trust (3) $142.2 BRAC Equity Issued to Sellers (4) 118.0 Total Sources $260.2 Estimated Uses Purchase Price of Equity $118.0 Net Debt Repayment (5) 32.5 Cash to Balance Sheet (3) 98.7 Estimated Fees and Expenses (6) 11.0 Total Uses $260.2 (1) Payable based on achieving a share price of at least $13.00 for 30 consecutive calendar days within five years of transac tio n close. (2) Additional consideration includes 3.8 million warrants with identical terms to existing BRAC warrants. (3) Assumes no redemption of public shares, based on $ 142.2 million of pre - transaction cash estimated in BRAC Trust at time of transaction close. (4) Comprised of 11.6 million common shares valued at $10.17 per share. (5) Comprised of $ 35.0 million repayment of assumed debt and $2.5 million of assumed AES cash. (6) Comprised of a $2.0 million advisory fee, $ 8.3 million capital markets fee and $0.7 million in legal and miscellaneous expenses. (7) Based on share price of $10.17. Transaction Overview • Black Ridge Acquisition Corp. (“BRAC”) has entered into an agreement with Ourgame to acquire 100% of the equity of AES and WPT in exchange for common stock of BRAC and create Allied Esports Entertainment (“AESE” or the “Company”) • Combined company to continue to be listed on NASDAQ Capital Market (NASDAQ : AESE) • Estimated transaction close in Q1 2019 Valuation and Consideration • Transaction reflects a purchase price of ~$151 million for Allied Esports Entertainment, plus an additional $50 million in contingent share consideration (1) — AES existing shareholders will receive 11.6 million BRAC shares as consideration, valued at $10.17 per share (2) — AESE will be purchased on a debt free basis Transaction Overview

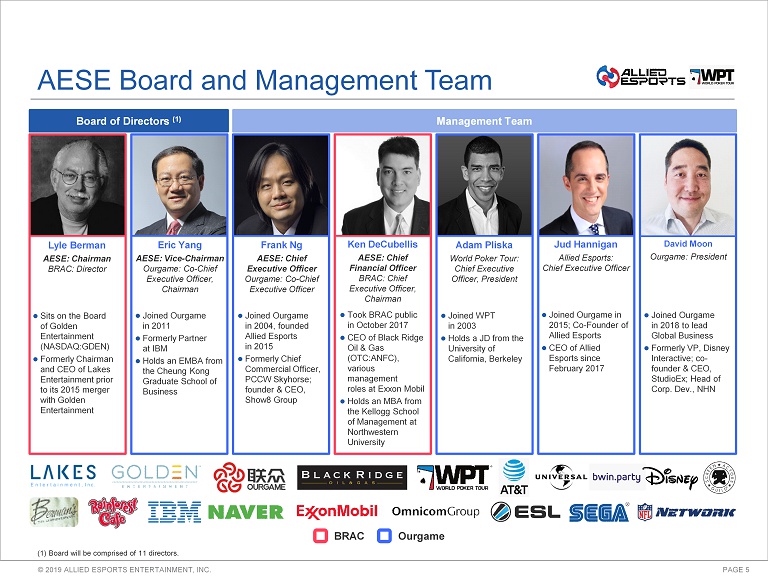

PAGE 5 © 2019 ALLIED ESPORTS ENTERTAINMENT, INC. AESE Board and Management Team Board of Directors (1) Management Team Lyle Berman AESE: Chairman BRAC: Director • Sits on the Board of Golden Entertainment (NASDAQ:GDEN) • Formerly Chairman and CEO of Lakes Entertainment prior to its 2015 merger with Golden Entertainment Eric Yang AESE: Vice - Chairman Ourgame: Co - Chief Executive Officer, Chairman • Joined Ourgame in 2011 • Formerly Partner at IBM • Holds an EMBA from the Cheung Kong Graduate School of Business Frank Ng AESE: Chief Executive Officer Ourgame: Co - Chief Executive Officer • Joined Ourgame in 2004, founded Allied Esports in 2015 • Formerly Chief Commercial Officer, PCCW Skyhorse; founder & CEO, Show8 Group Ken DeCubellis AESE: Chief Financial Officer BRAC: Chief Executive Officer, Chairman • Took BRAC public in October 2017 • CEO of Black Ridge Oil & Gas (OTC:ANFC), various management roles at Exxon Mobil • Holds an MBA from the Kellogg School of Management at Northwestern University Adam Pliska World Poker Tour: Chief Executive Officer, President • Joined WPT in 2003 • Holds a JD from the University of California, Berkeley Jud Hannigan Allied Esport s : Chief Executive Officer • Joined Ourgame in 2015; Co - Founder of Allied Esports • CEO of Allied Esports since February 2017 David Moon Ourgame: President • Joined Ourgame in 2018 to lead Global Business • Formerly VP, Disney Interactive; co - founder & CEO, StudioEx; Head of Corp. Dev., NHN BRAC Ourgame (1) Board will be comprised of 11 directors.

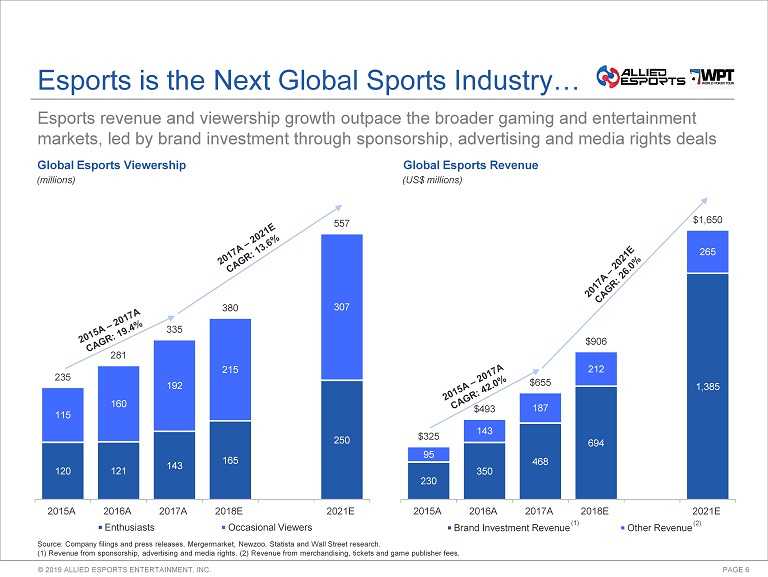

PAGE 6 © 2019 ALLIED ESPORTS ENTERTAINMENT, INC. Esports revenue and viewership growth outpace the broader gaming and entertainment markets, led by brand investment through sponsorship, advertising and media rights deals Source: Company filings and press releases, Mergermarket, Newzoo, Statista and Wall Street research. (1) Revenue from sponsorship, advertising and media rights. (2) Revenue from merchandising, tickets and game publisher fees. Global Esports Viewership Global Esports Revenue Esports is the Next Global Sports Industry… (US$ millions) (millions) 230 350 468 694 1,385 95 143 187 212 265 $325 $493 $655 $906 $1,650 2015A 2016A 2017A 2018E 2021E Brand Investment Revenue Other Revenue (2) (1) 120 121 143 165 250 115 160 192 215 307 235 281 335 380 557 2015A 2016A 2017A 2018E 2021E Enthusiasts Occasional Viewers

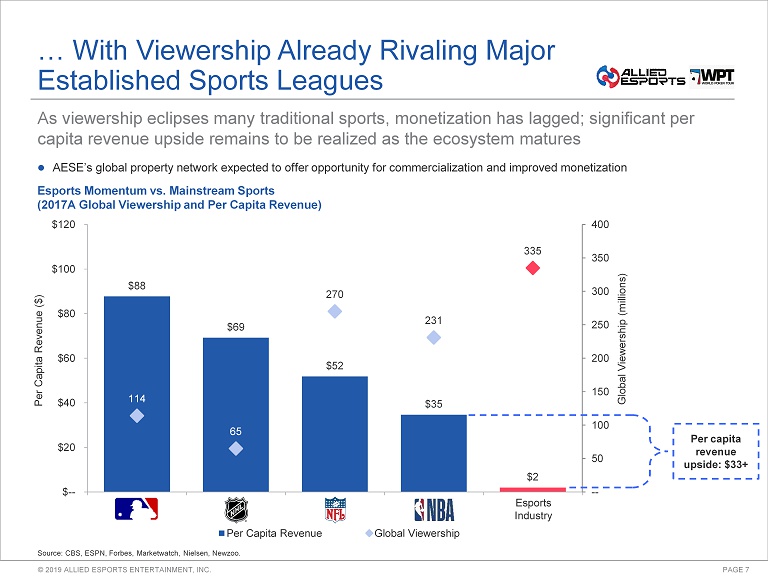

PAGE 7 © 2019 ALLIED ESPORTS ENTERTAINMENT, INC. $88 $69 $52 $35 $2 114 65 270 231 335 -- 50 100 150 200 250 300 350 400 $ -- $20 $40 $60 $80 $100 $120 MLB NHL NFL NBA Esports Global Viewership (millions) Per Capita Revenue ($) Per Capita Revenue Global Viewership As viewership eclipses many traditional sports, monetization has lagged; significant per capita revenue upside remains to be realized as the ecosystem matures • AESE’s global property network expected to offer opportunity for commercialization and improved monetization Source: CBS, ESPN, Forbes, Marketwatch, Nielsen, Newzoo. Esports Momentum vs. Mainstream Sports (2017A Global Viewership and Per Capita Revenue) … With Viewership Already Rivaling Major Established Sports Leagues Per capita revenue upside: $33+ Esports Industry

PAGE 8 © 2019 ALLIED ESPORTS ENTERTAINMENT, INC. In - Person Experiences • Live events • Global property network • Event affiliates Allied Esports Entertainment A Complete Esports Entertainment Platform Interactive Services • Direct - to - consumer online tournament platform • Subscription offering Multiplatform Content • Traditional media • Live streaming • Social channels A global leader in Esports Entertainment through integrated participant programming • In - person experiences across our affiliate network create a foundation for programmatic entertainment with real media value • Multiplatform content formats and distribution channels ensure native reach and coverage of the esports community • Interactive services extend participation online, integrating experiences across all of the touchpoints in our ecosystem

PAGE 9 © 2019 ALLIED ESPORTS ENTERTAINMENT, INC. Allied Esports Entertainment Introduction In - Person Experiences Interactive Services Multiplatform Content 1 2 3

PAGE 10 © 2019 ALLIED ESPORTS ENTERTAINMENT, INC. Esports Arena Las Vegas, located at Luxor Hotel & Casino, opened in March 2018 as the first dedicated esports arena on the Strip and is the Company’s flagship venue In - Person Experiences Flagship – Esports Arena Las Vegas 1 Retro Gaming Lounge Private Luxury VIP Lounge Owner’s Box Entrance Main Area Floor Broadcast Center & Production Arena Amenities Significance of Flagship • Flagship arena provides a venue for marquee esports events and championship tournaments , and more broadly acts as a production and distribution center for esports content • Premier venue for brand investment and in - bound partnerships, establishing the brand as a global mecca for the gaming community • Build cost per flagship arena of $20 million, with three expected globally by 2022E Premier Events

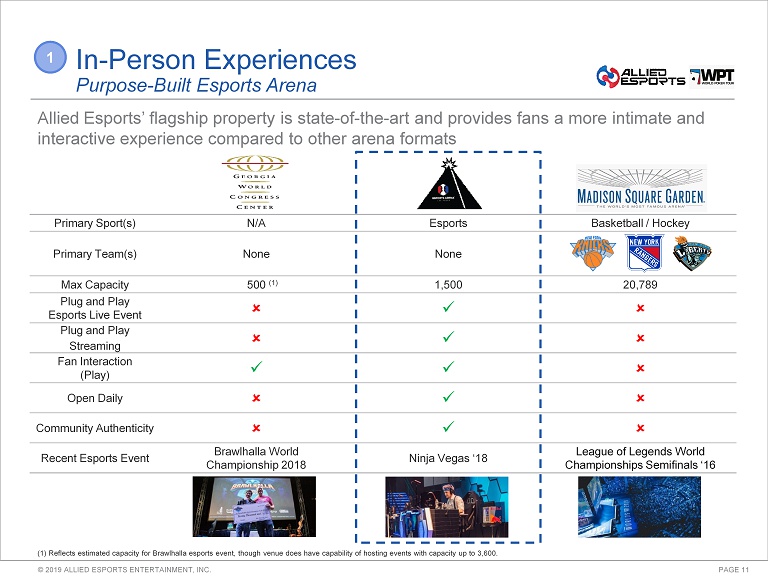

PAGE 11 © 2019 ALLIED ESPORTS ENTERTAINMENT, INC. Allied Esports’ flagship property is state - of - the - art and provides fans a more intimate and interactive experience compared to other arena formats Primary Sport(s) N/A Esports Basketball / Hockey Primary Team(s) None None Max Capacity 500 (1) 1,500 20,789 Plug and Play Esports Live Event - x - Plug and Play Streaming - x - Fan Interaction (Play) x x - Open Daily - x - Community Authenticity - x - Recent Esports Event Brawlhalla World Championship 2018 Ninja Vegas ‘18 League of Legends World Championships Semifinals ‘16 In - Person Experiences Purpose - Built Esports Arena 1 (1) Reflects estimated capacity for Brawlhalla esports event, though venue does have capability of hosting events with capaci ty up to 3,600.

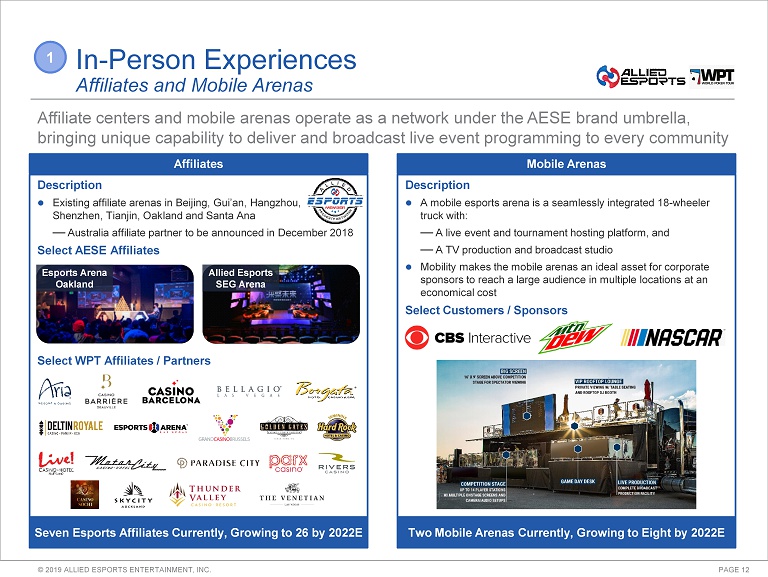

PAGE 12 © 2019 ALLIED ESPORTS ENTERTAINMENT, INC. In - Person Experiences Affiliates and Mobile Arenas 1 Affiliate centers and mobile arenas operate as a network under the AESE brand umbrella, bringing unique capability to deliver and broadcast live event programming to every community Mobile Arenas Description • A mobile esports arena is a seamlessly integrated 18 - wheeler truck with: — A live event and tournament hosting platform, and — A TV production and broadcast studio • Mobility makes the mobile arenas an ideal asset for corporate sponsors to reach a large audience in multiple locations at an economical cost Select Customers / Sponsors Affiliates Description • Existing affiliate arenas in Beijing, Gui’an, Hangzhou, Shenzhen , Tianjin, Oakland and Santa Ana — Australia affiliate partner to be announced in December 2018 Select AESE Affiliates Select WPT Affiliates / Partners Two Mobile Arenas Currently, Growing to Eight by 2022E Seven Esports Affiliates Currently, Growing to 26 by 2022E Allied Esports SEG Arena Esports Arena Oakland

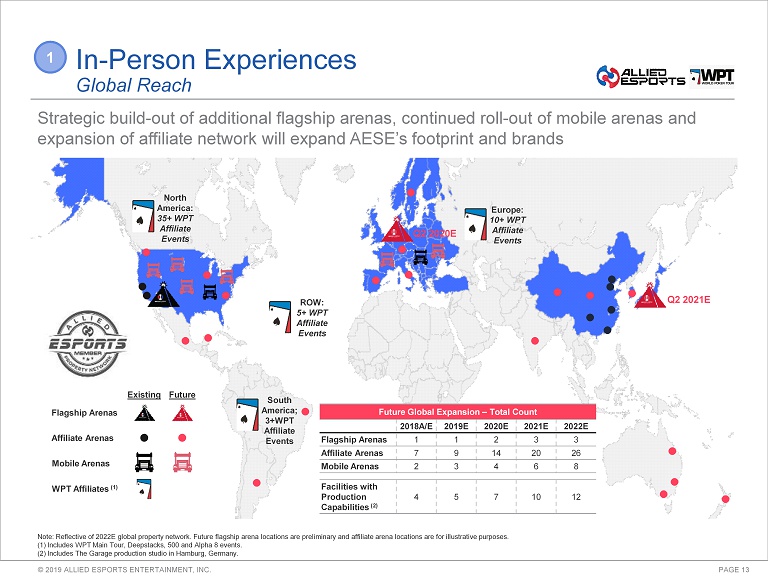

PAGE 13 © 2019 ALLIED ESPORTS ENTERTAINMENT, INC. In - Person Experiences Global Reach 1 Strategic build - out of additional flagship arenas, continued roll - out of mobile arenas and expansion of affiliate network will expand AESE’s footprint and brands Note: Reflective of 2022E global property network. Future flagship arena locations are preliminary and affiliate arena locati ons are for illustrative purposes. (1) Includes WPT Main Tour, Deepstacks, 500 and Alpha 8 events. (2) Includes The Garage production studio in Hamburg, Germany. North America: 35+ WPT Affiliate Events Europe: 10+ WPT Affiliate Events ROW: 5+ WPT Affiliate Events South America; 3+WPT Affiliate Events Flagship Arenas Affiliate Arenas Mobile Arenas Existing Future WPT Affiliates (1) Q2 2020E Future Global Expansion – Total Count 2018A/E 2019E 2020E 2021E 2022E Flagship Arenas 1 1 2 3 3 Affiliate Arenas 7 9 14 20 26 Mobile Arenas 2 3 4 6 8 Facilities with Production Capabilities (2) 4 5 7 10 12 Q2 2021E

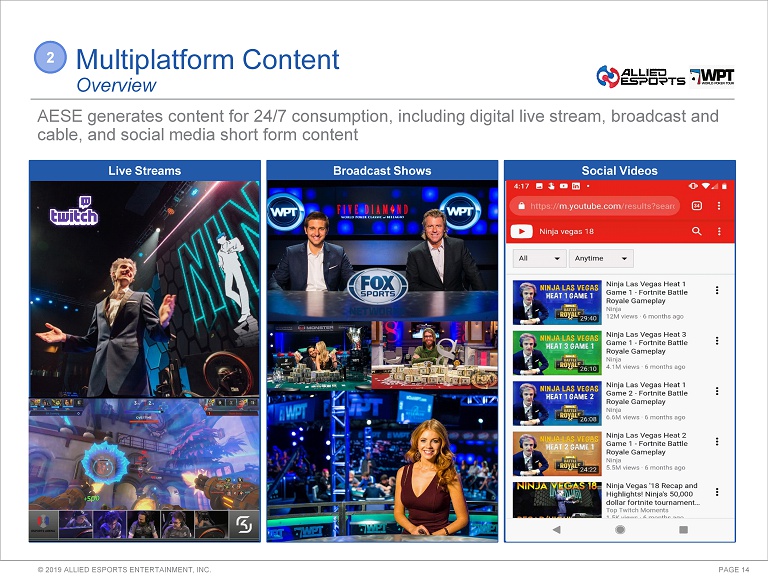

PAGE 14 © 2019 ALLIED ESPORTS ENTERTAINMENT, INC. Multiplatform Content Overview 2 AESE generates content for 24/7 consumption, including digital live stream, broadcast and cable, and social media short form content Live Streams Broadcast Shows Social Videos

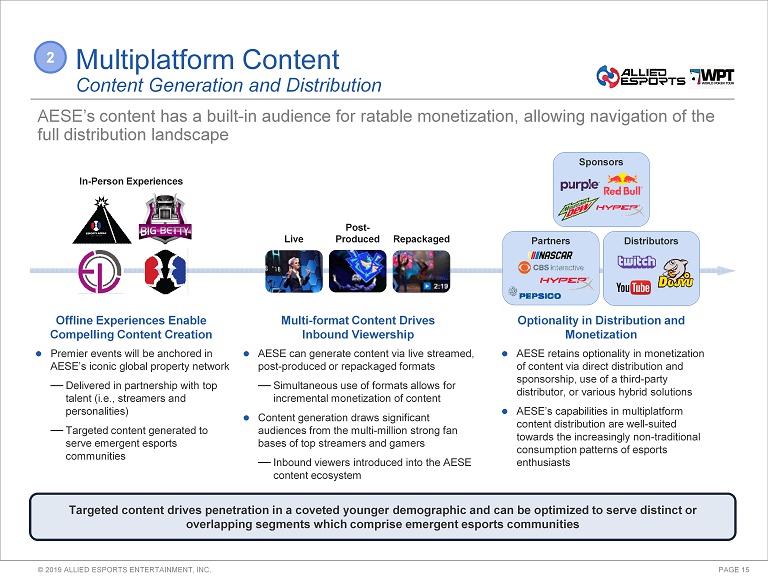

PAGE 15 © 2019 ALLIED ESPORTS ENTERTAINMENT, INC. Multiplatform Content Content Generation and Distribution 2 AESE’s content has a built - in audience for ratable monetization, allowing navigation of the full distribution landscape • AESE retains optionality in monetization of content via direct distribution and sponsorship, use of a third - party distributor, or various hybrid solutions • AESE’s capabilities in multiplatform content distribution are well - suited towards the increasingly non - traditional consumption patterns of esports enthusiasts • AESE can generate content via live streamed, post - produced or repackaged formats — Simultaneous use of formats allows for incremental monetization of content • Content generation draws significant audiences from the multi - million strong fan bases of top streamers and gamers — Inbound viewers introduced into the AESE content ecosystem • Premier events will be anchored in AESE’s iconic global property network — Delivered in partnership with top talent (i.e., streamers and personalities) — Targeted content generated to serve emergent esports communities Offline Experiences Enable Compelling Content Creation Multi - format Content Drives Inbound Viewership Optionality in Distribution and Monetization Live Post - Produced Repackaged In - Person Experiences Distributors Partners Sponsors Targeted content drives penetration in a coveted younger demographic and can be optimized to serve distinct or overlapping segments which comprise emergent esports communities

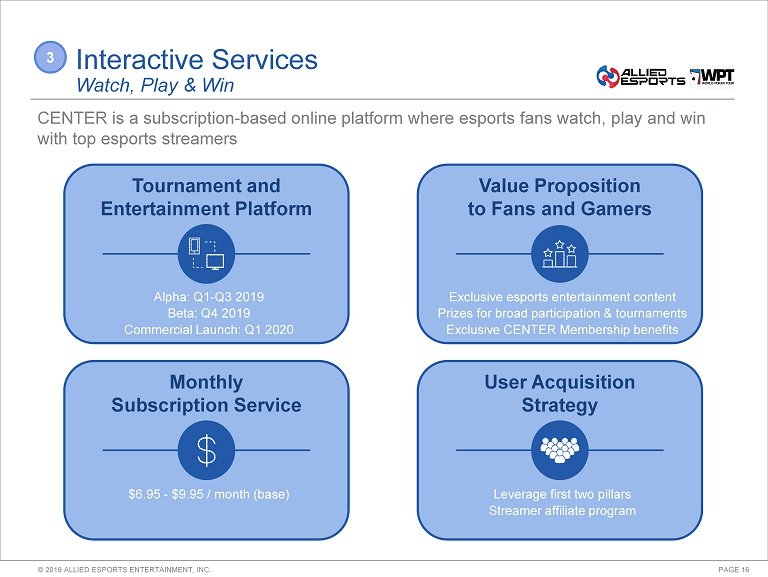

PAGE 16 © 2019 ALLIED ESPORTS ENTERTAINMENT, INC. CENTER is a subscription - based online platform where esports fans watch, play and win with top esports streamers 3 Interactive Services Watch, Play & Win User Acquisition Strategy Leverage first two pillars Streamer affiliate program Tournament and Entertainment Platform Alpha: Q1 - Q3 2019 Beta: Q4 2019 Commercial Launch: Q1 2020 Monthly Subscription Service $6.95 - $9.95 / month (base) Value Proposition to Fans and Gamers Exclusive esports entertainment content Prizes for broad participation & tournaments Exclusive CENTER Membership benefits

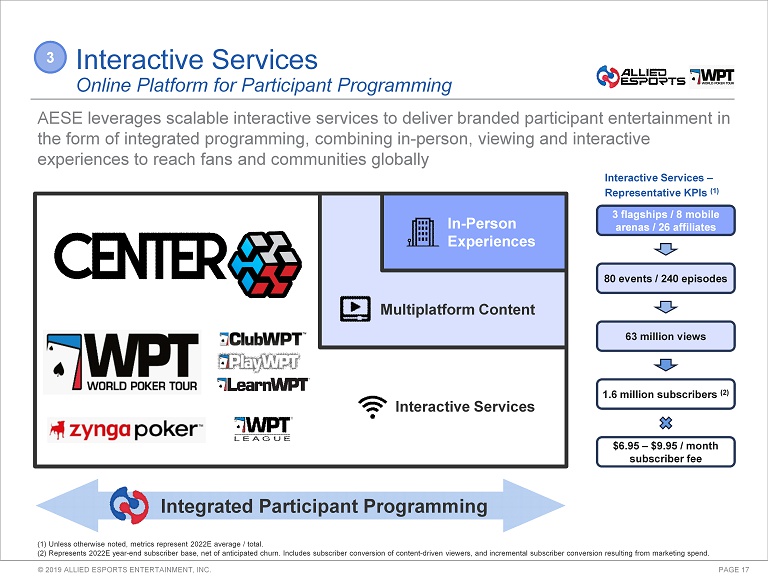

PAGE 17 © 2019 ALLIED ESPORTS ENTERTAINMENT, INC. AESE leverages scalable interactive services to deliver branded participant entertainment in the form of integrated programming, combining in - person, viewing and interactive experiences to reach fans and communities globally 3 Interactive Services Online Platform for Participant Programming In - Person Experiences Multiplatform Content Interactive Services Integrated Participant Programming Interactive Services – Representative KPIs (1) (1) Unless otherwise noted, metrics represent 2022E average / total. (2) Represents 2022E year - end subscriber base, net of anticipated churn. Includes subscriber conversion of content - driven viewer s, and incremental subscriber conversion resulting from marketing spend. $6.95 – $9.95 / month subscriber fee 3 flagships / 8 mobile arenas / 26 affiliates 80 events / 240 episodes 63 million views 1.6 million subscribers (2)

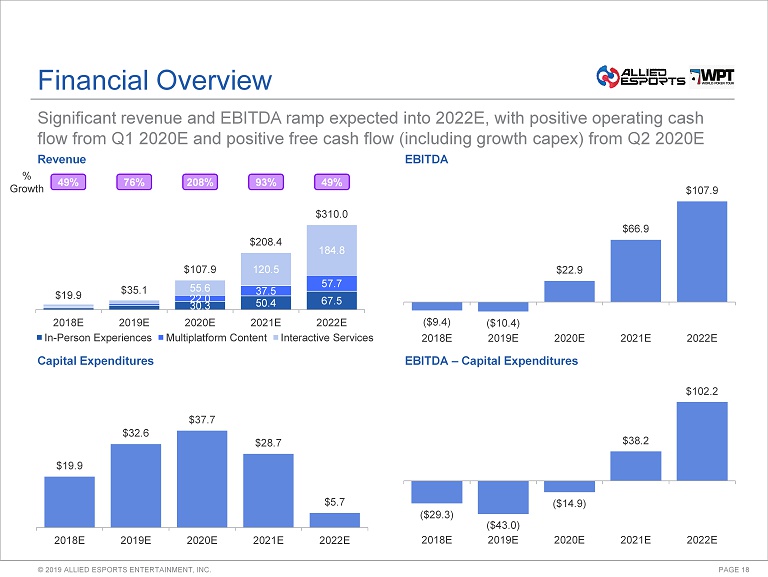

PAGE 18 © 2019 ALLIED ESPORTS ENTERTAINMENT, INC. ($29.3) ($43.0) ($14.9) $38.2 $102.2 2018E 2019E 2020E 2021E 2022E 30.3 50.4 67.5 22.0 37.5 57.7 55.6 120.5 184.8 $19.9 $35.1 $107.9 $208.4 $310.0 2018E 2019E 2020E 2021E 2022E In - Person Experiences Multiplatform Content Interactive Services ($9.4) ($10.4) $22.9 $66.9 $107.9 2018E 2019E 2020E 2021E 2022E $19.9 $32.6 $37.7 $28.7 $5.7 2018E 2019E 2020E 2021E 2022E Significant revenue and EBITDA ramp expected into 2022E, with positive operating cash flow from Q1 2020E and positive free cash flow (including growth capex) from Q2 2020E EBITDA Capital Expenditures EBITDA – Capital Expenditures Revenue Financial Overview % Growth 49% 76% 208% 93% 49%