UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

14A

(Rule 14a-101)

INFORMATION

REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant | ☒ | |||

| Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement. | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). | |

| ☐ | Definitive Proxy Statement. | |

| ☒ | Definitive Additional Materials. | |

| ☐ | Soliciting Material Pursuant to §240.14a-12. |

ALLIED ESPORTS ENTERTAINMENT, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

ALLIED ESPORTS ENTERTAINMENT, INC.

17877

Von Karman Avenue, Suite 300

Irvine, California 92614

NOTICE OF RECONVENING OF THE

ANNUAL

MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 30, 2021

TO THE STOCKHOLDERS OF ALLIED ESPORTS ENTERTAINMENT, INC.:

The 2021 annual meeting of stockholders (the “annual meeting”) of Allied Esports Entertainment, Inc. (the “Company”), which was scheduled for October 14, 2021, was convened and adjourned on October 14, 2021 without any business being conducted due to the fact that quorum was not present at the annual meeting.

NOTICE IS HEREBY GIVEN that the annual meeting will be reconvened virtually and exclusively online via live audio-only webcast, on December 30, 2021, at 11:00 a.m. Eastern time, or at any adjournment or adjournments thereof, for the following purposes:

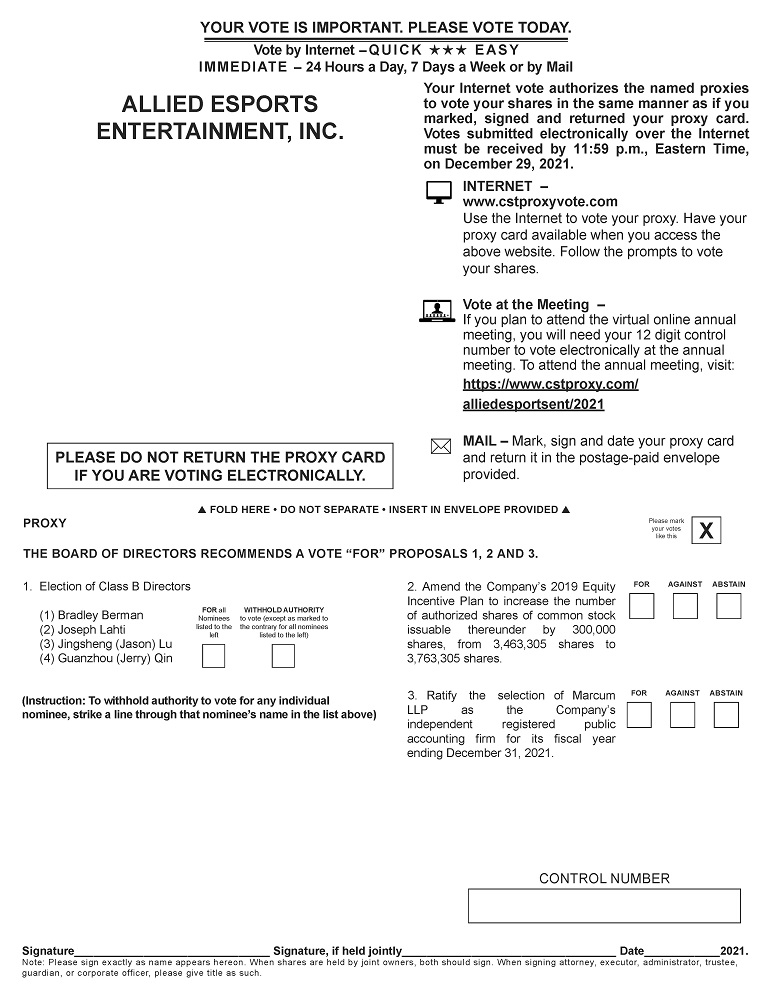

| 1. | To elect four Class B directors nominated by the Board of Directors to serve for a three-year term expiring in 2024 (Proposal 1); |

| 2. | To consider and vote on whether to approve an amendment to the Company’s 2019 Equity Incentive Plan that would increase the number of authorized shares of common stock issuable thereunder by 300,000 shares, from 3,463,305 shares to 3,763,305 shares (Proposal 2); |

| 3. | To ratify the selection by the audit committee of the Board of Directors of Marcum LLP as the Company’s independent registered public accounting firm for its fiscal year ending December 31, 2021 (Proposal 3); and |

| 4. | To transact any other business as may properly come before the annual meeting or any adjournments thereof. |

These items of business are more fully described in the Company’s Proxy Statement dated August 23, 2021 (the “Proxy Statement”), that was previously sent to you in connection with the annual meeting. The accompanying Proxy Statement Supplement (the “Supplement”) contains additional information supersedes and supplements any conflicting information in the Proxy Statement.

You will be able to attend the annual meeting online, submit your questions during the annual meeting and vote your shares electronically during the annual meeting by visiting https://www.cstproxy.com/alliedesportsent/2021. Because the annual meeting is being conducted electronically, you will not be able to attend the annual meeting in person.

The original record date for the annual meeting, August 23, 2021, remains the record date for the reconvened meeting. Only stockholders of record at the close of business on that date may vote at the re-convened annual meeting or any adjournment or postponement thereof.

| By Order of the Board of Directors, | |

| /s/ Libing (Claire) Wu | |

| Libing (Claire) Wu | |

| Chief Executive Officer |

November 23, 2021

2

Your vote is important. Whether or not you attend the reconvened annual meeting virtually, it is important that your shares be represented. You may vote your proxy through the Internet, or by mail by completing and returning the proxy card for the reconvened annual meeting enclosed with this Notice. Voting instructions are printed on your proxy card for the reconvened annual meeting and included in the Proxy Statement. If you participate virtually in the reconvened annual meeting, you may vote at that time, even if you previously submitted your proxy card. Even if you plan to participate in the reconvened annual meeting, we urge you to vote as soon as possible over the Internet or by mail as described in the Proxy Statement.

All Company stockholders that submitted a proxy prior to the date of this Notice through the Internet, or by mail by completing and returning the proxy card initially mailed to you in connection with the annual meeting that was to be held on October 14, 2021 should submit a new proxy card indicating their vote through the foregoing means as the proposals at the reconvened annual meeting and the contents of the proxy card have changed.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE VIRTUAL STOCKHOLDER MEETING TO BE RECONVENED ON DECEMBER 30, 2021:

The proxy statement for the annual meeting and the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020, each of which is included with this Notice, are also available to you on the Internet. We encourage you to review all of the important information contained in the proxy materials before voting. To view the proxy statement, as supplemented from time to time, and Annual Report on Form 10-K on the Internet, visit https://ir.alliedesportsent.com/.

3

ALLIED ESPORTS ENTERTAINMENT, INC.

17877 Von Karman Avenue, Suite 300

Irvine, California 92614

PROXY STATEMENT SUPPLEMENT

November 23, 2021

This is a supplement (this “Supplement”) to the Proxy Statement of Allied Esports Entertainment, Inc. (the “Company” or “AESE”) dated August 23, 2021 (the “Proxy Statement”), that was previously sent to you in connection with the Company’s solicitation of stockholder proxies in connection with proposals to be considered by the Company’s stockholders at its 2021 Annual Meeting of Stockholders.

Terms that are used in this Supplement have the meanings set forth in the Proxy Statement, unless a new definition for such term is provided in this Supplement. The following information supersedes and supplements any conflicting information in the Proxy Statement.

QUESTIONS AND ANSWERS ABOUT THIS SUPPLEMENT AND VOTING

Why am I receiving these materials?

We are providing you with these proxy materials because the board of directors (the “Board of Directors” or the “Board”) of Allied Esports Entertainment, Inc. (sometimes referred to as “we,” “us,” “our” or the “Company”) is soliciting your proxy to vote at the 2021 annual meeting of stockholders (the “annual meeting”), including at any adjournments or postponements thereof.

The annual meeting, which was scheduled for October 14, 2021, was convened and adjourned on October 14, 2021 without any business being conducted due to the fact that quorum was not present at the annual meeting. The annual meeting will be reconvened on December 30, 2021, at 11:00 a.m. Eastern time (8:00 a.m. Pacific time), virtually and exclusively online via live audio-only webcast at https://www.cstproxy.com/alliedesportsent/2021.

We are sending to all stockholders of record entitled to vote at the annual meeting the attached notice of reconvening the annual meeting and this Supplement on or about November 30, 2021 pursuant to applicable Delaware law, as the date of reconvening the annual meeting will exceed 30 days from October 14, 2021, the date that the annual meeting was initial convened. This Supplement also includes additional information related to the proposals to be considered at the reconvened annual meeting, which have been revised since the annual meeting was adjourned on October 14, 2021.

What am I voting on?

There are three matters scheduled for a vote at the reconvened annual meeting:

1. To elect four Class B directors nominated by the Board of Directors to serve for a three-year term expiring in 2024 (Proposal 1);

2. To consider and vote on whether to approve an amendment to the Company’s 2019 Equity Incentive Plan that would increase the number of authorized shares of common stock issuable thereunder by 300,000 shares, from 3,463,305 shares to 3,763,305 shares (Proposal 2); and

3. To ratify the selection by the audit committee of the Board of Directors of Marcum LLP as the Company’s independent registered public accounting firm for its fiscal year ending December 31, 2021 (Proposal 3).

4

If I previously voted in advance of, or at, the annual meeting on October 14, 2021, do I need to vote again?

As noted above, the proposals to be considered at the reconvened annual meeting have changed, and so has the proxy card for which stockholders may cast their votes by proxy. As a result, all Company stockholders that voted a proxy prior to the date of this Notice, whether through the Internet, or by mail should submit a new proxy card indicating their vote through the Internet, or by mail by completing and returning the enclosed proxy card.

If you are a stockholder of record and do not vote by completing a new proxy card, through the Internet or by voting electronically at the reconvened annual meeting, your shares will not be voted, even if you submitted a proxy prior to the date of this Notice to vote at the annual meeting convened on October 14, 2021.

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For” the election of all four nominees for director, “For” the amendment to our 2019 Equity Incentive Plan, and “For” the ratification of Marcum LLP as the Company’s independent registered public accounting firm for its fiscal year ending December 31, 2021. If any other matter is properly presented at the reconvened annual meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

How do I vote?

With respect to Proposal 1, you may vote “For” all the nominees to the Board of Directors or you may “Withhold” your vote for any of the nominees you specify. With respect to the other proposals, you may vote “For” or “Against,” or you may abstain from voting.

Stockholder of Record — Shares Registered in Your Name: If you are a stockholder of record, you may vote at the reconvened annual meeting, vote by proxy using the enclosed proxy card, or vote by proxy via the Internet. Whether or not you plan to attend the virtual meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the reconvened virtual meeting and vote your shares even if you have already voted by proxy:

| ● | To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the reconvening of the annual meeting, we will vote your shares as you direct. |

| ● | To vote online before the reconvening of the annual meeting, go to www.cstproxyvote.com and transmit your voting instructions up until 11:59 p.m. Eastern Time on December 29, 2021. Have your proxy card in hand when you access the web site and follow the instructions to vote your shares. |

| ● | To vote online during the reconvened annual meeting, visit https://www.cstproxy.com/alliedesportsent/2021. Be sure to have your proxy card available and follow the instructions given on the secure website. You will need the 12-digit control number that is printed on your proxy card to vote online at the annual meeting. |

Beneficial Owner — Shares Registered in the Name of a Broker or Bank: If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should receive a proxy card and voting instructions with these proxy materials from that organization rather than from us. Simply complete and mail the proxy card to ensure that your vote is submitted to your broker or bank. Alternatively, you may vote over the Internet as instructed by your broker or bank. To vote in real time at the reconvened annual meeting, you must obtain a valid legal proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials or contact your broker or bank to request a proxy form.

We provide Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers.

What are “broker non-votes”?

When a beneficial owner of shares held in street name does not give voting instructions to his or her broker, bank or other securities intermediary holding his or her shares as to how to vote on matters deemed to be “non-routine” under NYSE, the broker, bank or other such agent cannot vote the shares. These un-voted shares are counted as “broker non-votes.” Proposals 1 and 2 are considered to be “non-routine” under NYSE rules and therefore, we expect broker non-votes to exist in connection with each proposal. Broker non-votes will have no effect on Proposal 1.

5

How many votes are needed to approve each proposal?

The following table summarizes the minimum vote needed to approve each proposal and the effect of abstentions and broker non-votes.

| Proposal No. | Proposal Description | Vote Required for Approval | Effect

of Abstentions |

Effect of Broker

Non-Votes | ||||

| 1 | Election of directors | Directors will be elected by a plurality of the votes cast by the holders of shares present or represented by proxy and entitled to vote on the election of directors. The four nominees receiving the most “For” votes will be elected as directors | No effect | No effect | ||||

| 2 | Increasing the number of authorized shares issuable under the 2019 Equity Incentive Plan | “For” votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote on the matter | Against | Against | ||||

| 3 | Ratification of the selection of Marcum LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021 | “For” votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote on the matter | Against | Not applicable(1) |

| (1) | This proposal is considered to be a “routine” matter under NYSE rules. Accordingly, if you hold your shares in street name and do not provide voting instructions to your broker, bank or other agent that holds your shares, your broker, bank or other agent has discretionary authority under NYSE rules to vote your shares on this proposal. |

What is the quorum requirement?

A quorum of the Company’s stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares are present at the meeting or represented by proxy. On the record date, there were 39,141,907 shares of common stock outstanding and entitled to vote. Thus, the holders of 19,570,954 shares of common stock must be present at the reconvened meeting or represented by proxy at the reconvened meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in real time at the reconvened annual meeting. Abstentions and broker non-votes will be counted towards the quorum requirement.

6

PROPOSAL 1

ELECTION OF DIRECTORS

On November 5, 2021, Alexander Misch, a Class B Director of Allied Esports Entertainment, Inc. (the “Company”), resigned from the Company’s Board of Directors. Mr. Misch served on the Company’s Nominating and Corporate Governance and Compensation Committees. On November 11, 2021, the Board of Directors appointed Mr. Guanzhou (Jerry) Qin to the Board of Directors as a Class B Director to fill the vacancy created by Mr. Misch’s resignation.

Our Board of Directors previously nominated Mr. Misch for reelection to the Board as Class B Director as part of Proposal 1 to be considered by our stockholders at the annual meeting. In light of Mr. Misch’s resignation, and the appointment by the Board of Mr. Qin to serve as a Class B Director, our Board of Directors is recommending to the Company’s stockholders that Mr. Qin be elected to the Board of Directors as a Class B Director, and no longer recommends the election of Mr. Misch to the Board of Directors. Accordingly, the following table sets forth each Class B Director nominee to be elected at the reconvened annual meeting, the year each nominee was first elected as a director, the position(s) currently held by each nominee with us and the year each nominee’s term will expire, if such nominee is elected at the annual meeting:

| Name of Nominee | Position(s) with the Company | Year First Became a Director | Year Proposed Term Will Expire | |||||||

| Bradley Berman | Director | 2019 | 2024 | |||||||

| Joseph Lahti | Director | 2019 | 2024 | |||||||

| Jingsheng (Jason) Lu | Director | 2019 | 2024 | |||||||

| Guanzhou (Jerry) Qin | Director | 2021 | 2024 |

Jerry Qin is a director of Allied Esports Entertainment. Mr. Qin brings strong management skills from Fortune 500 companies, hands-on knowledge at high-tech startups, and deep experience in finance and accounting. Most recently Mr. Qin has worked with Tencent Holdings as Finance Director of Platform & Content Group from February 2020 to September 2021, overseeing Tencent News, Tencent Sports and various products. Prior to this role, Mr Qin served as the Head of Finance at Aibee Inc., a top artificial-intelligence start-up, from September 2018 until February 2020. Mr. Qin also served as the Senior Finance Director of APAC (China, Japan, India and others) at TripAdvisor (Nasdaq: TRIP) from June 2017 until August 2018. Mr. Qin also served as the Finance Director of APAC (China, Japan and Korea) at Glu Mobile, a top mobile game developer, and as a consultant at Andersen/PWC. Mr. Qin holds Australia CPA, and MBA degree from Fordham University/Peking University.

On November 11, 2021, the Board of Directors elected Yanyang Li, a current director of the Company to serve as co-Chairman of the Board of Directors with the existing Chairman, Lyle Berman.

Management Updates

On November 11, 2021, the Board of Directors appointed certain current directors of the Company into new management roles to accelerate the Company’s progress in identifying and consummating the acquisition of one or more companies and concluding a possible disposition of the Company’s esports division. The Board of Directors appointed Lyle Berman as President, Yinghua Chen as Chief Investment Officer and Adam Pliska as a special consultant to provide the services described below.

Lyle Berman

Mr. Berman, as President of the Company, intends to focus his efforts on (1) managing investor relations, (2) advancing the sale of the Company’s e-sports division, and (3) evaluating and providing strategic input related to the acquisition of one or more companies.

7

Mr. Berman has served as a director of the Company since May 2017 (when the Company at the time of such election was Black Ridge Acquisition Corp.). Mr. Berman has been a director of Sow Good Inc., f/k/a Black Ridge Oil & Gas, Inc., since October 2016, and is also a director of Mill City Ventures III, Ltd., Auego Affinity Marketing, Inc., Poker52, LLC, Redstone American Grill, Inc., LubeZone, Inc., Drake’s Organic Spirits, LLC, and InsurTech Holdings, LLC. Mr. Berman also served as a director of Golden Entertainment, Inc. from 2015 through 2021. Since June 1990, Mr. Berman has been the chairman and chief executive officer of Berman Consulting Corporation, a private consulting firm he founded. Mr. Berman began his career with Berman Buckskin, his family’s leather business, which he helped grow into a major specialty retailer with 27 outlets. After selling Berman Buckskin to W.R. Grace in 1979, Mr. Berman continued as president and chief executive officer and led the company to become one the country’s largest retail leather chains, with over 200 stores nationwide. In 1990, Mr. Berman participated in the founding of Grand Casinos, Inc. Mr. Berman is credited as one of the early visionaries in the development of casinos outside of the traditional gaming markets of Las Vegas and Atlantic City. In less than five years, the company opened eight casino resorts in four states. In 1994, Mr. Berman financed the initial development of Rainforest Cafe. He served as the chairman and chief executive officer from 1994 unti1 2000. In October 1995, Mr. Berman was honored with the B’nai B’rith “Great American Traditions Award.” In April 1996, he received the Gaming Executive of the Year Award; in 2004, Mr. Berman was inducted into the Poker Hall of Fame; and in 2009, he received the Casino Lifetime Achievement Award from Raving Consulting & Casino Journal. In 1998, Lakes Entertainment, Inc. was formed. In 2002, as chairman of the board and chief executive officer of Lakes Entertainment, Inc., Mr. Berman was instrumental in creating the World Poker Tour. Mr. Berman served as the executive chairman of the board of WPT Enterprises, Inc. (later known as Voyager Oil & Gas, Inc. and Emerald Oil, Inc.) from its inception in February 2002 until July 2013. Mr. Berman also served as a director of PokerTek, Inc. from January 2005 until October 2014, including serving as chairman of the board from January 2005 until October 2011. Mr. Berman has a degree in business administration from the University of Minnesota.

Yinghua Chen

Yinghua Chen, as the Chief Investment Officer, will primarily focus on identifying and working with an investment banker and the Company’s executive team to: (1) evaluate potential acquisition candidates and to provide specialized insight; (2) provide suggestions and recommendations related to possible acquisition structures; and (3) overseeing cash position to ensure success of one or more acquisitions.

Ms. Chen is a Co-Founder of Aupera Technologies, a leading video AI technology company, where she is responsible for corporate financing, business development, and strategic partnership. She has successfully raised multiple rounds of funding for Aupera, including from Silicon Valley giant Xilinx (Nasdaq: XLNX). Prior to this, she served as the Executive Vice President of Anthill Resources, a natural resources investment company in Canada, where she oversaw business operations and investment activities. Ms. Chen is also the former Managing Director of China for The Cavendish Group, a UK B2B media and public relations company. In that role, Ms. Chen built up subscriber networks for over ten vertical industry media products and managed the Group’s strategic relationship with the Boao Forum for Asia. Ms. Chen was also part of the founding team of The Balloch Group, a boutique investment banking firm, later acquired by Canaccord Genuity, where she specialized in financial, pharmaceutical, resources and media industry transactions. Ms. Chen holds an EMBA from the University of Paris I: Panthéon-Sorbonne and a Bachelor of Arts degree from the University of International Business and Economics.

Adam Pliska

Mr. Pliska, as a strategic consultant to the Company, will draw upon his specialized expertise and industry experience to advance: (1) the sale of the Company’s e-sports division, and (2) the evaluation and strategy related to a potential acquisition in the online-gaming industry.

Mr. Pliska has served as a director since August 2019. Mr. Pliska served as the Company’s President from August 2019 to July 2021, when the Company sold the World Poker Tour. He has been with the World Poker Tour since 2003. As President and CEO of WPT, Mr. Pliska has overseen the entire WPT business portfolio, including but not limited to live events, online services, televised broadcasts, and WPT office personnel in Los Angeles, London and Beijing. He is one of the longest serving executives in the poker industry and was named the American Poker Awards Industry Person of the Year for 2014. Under his watch, the WPT has witnessed massive global growth from 14 events to over 60 worldwide on 6 continents, has maintained historic ratings of one of the longest running television shows in US history and has awarded more than a billion dollars over its 18 years. In addition to his position as CEO, Mr. Pliska serves as Executive Producer of the World Poker Tour television show and is the co-writer of the WPT Theme song Rise Above. Mr. Pliska holds a B.A. from the University of Southern California’s School of Cinematic Arts and a J.D. from the University of California, Berkeley’s Law School, Boalt Hall.

Libing (Claire) Wu continues to serve as the Company’s Chief Executive Officer and General Counsel, and Roy Anderson continues to serve as the Company’s Chief Financial Officer.

8

Committee Updates

In connection with Mr. Qin’s appointment to the Board of Directors and the appointment of Mr. Berman as President and Ms. Chen as Chief Investment Officer, the Company made the following updates to its committees: (i) Mr. Qin, Bradley Berman and Joe Lahti were appointed to the Nominating and Corporate Governance Committee, Ms. Chen and Lyle Berman were removed from such committee and Mr. Li was appointed chair of such committee; and (ii) Mr. Qin was appointed to serve on the Audit Committee and Mr. Chen was removed from such committee.

Compensation

In connection with the appointments identified above, the Board approved the issuance of 75,000, 50,000 and 25,000 options to Yinghua Chen, Lyle Berman and Adam Pliska, respectively, for their services to be provided. Such options are subject to traditional vesting in equal installments over four years, subject to an accelerated vesting in the event of an acquisition of another company, and availability of shares under the Company’s outstanding 2019 Equity Incentive Plan. The appointment of each of Yinghua Chen, Lyle Berman and Adam Pliska as indicated above made such individuals ineligible to receive annual directors fees for non-executives of $30,000 per year per the Company’s director compensation policy. In recognition such fact and the services to be provided by such individuals, the Board of Directors also approved annual compensation of $30,000 to each of Yinghua Chen, Lyle Berman and Adam Pliska for their services.

Vote Required

Directors are elected by a plurality of the votes of the holders of shares present in person or represented by proxy and entitled to vote on the election of directors. The nominees receiving the highest number of “For” votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the four nominees named above. If any nominee should withdraw or otherwise become unavailable for reasons not presently known, the proxies which would have otherwise been voted for that nominee may be voted for a substitute director nominee selected by our Board of Directors.

The Board of Directors recommends that you vote “FOR” the election of each Class B Director nominee named above.

PROPOSAL 2

APPROVAL

OF AN INCREASE IN THE NUMBER OF AUTHORIZED SHARES OF

THE 2019 EQUITY INCENTIVE PLAN

The Proxy Statement included a proposal to amend the Company’s 2019 Equity Incentive Plan (the “Equity Plan”) to amend the Equity Plan to increase the number of authorized shares under the Equity Plan by 4,336,695 shares, from 3,463,305 to 7,800,000. After discussions with certain of the Company’s stockholders, the Board of Director has reduced the proposed increase in the number of shares authorized for issuance under the Equity Plan, and is now is recommending that the Company’s stockholders approve an amendment to the Equity Plan to increase the number of authorized shares under the Equity Plan by 300,000 shares, from 3,463,305 to 3,763,305 shares.

The current number of shares of Company common stock authorized for issuance under the Equity Plan is 3,463,305. Currently, there remain only 83,444 shares of Company common stock available for issuance under the Equity Plan. Given the limited number of remaining shares authorized to be issued under the Equity Plan, the Board of Directors believes it is in the best interest of the Company to increase the number of authorized shares under the Equity Plan by 300,000 shares, from 3,463,305 shares to 3,763,305 shares, so that the Board of Directors may continue to utilize the Equity Plan to further align the interests of eligible participants with those of the Company’s stockholders by providing long-term incentive compensation opportunities tied to the performance of the Company’s common stock.

Vote Required

Amending the Equity Plan requires the affirmative vote of a majority of the issued and outstanding shares of Company common stock represented in person or by proxy at the reconvened meeting and entitled to vote thereon.

The Board recommends that you vote “FOR” the amendment of the Equity Plan.

9

PROPOSAL 3

RATIFICATION

OF THE APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our Board of Directors and management are committed to the quality, integrity and transparency of the Company’s financial reports. In accordance with the duties set forth in its written charter, the Audit Committee of our Board of Directors has appointed Marcum LLP as our independent registered public accounting firm for our 2021 fiscal year. A representative of Marcum LLP is not expected to attend the reconvened annual meeting. To the extent that a representative of Marcum does virtually attend the reconvened annual meeting, he or she will be available to respond to appropriate questions from stockholders, and will have the opportunity to make a statement if he or she desires to do so.

We are not required by statute or our bylaws or other governing documents to obtain stockholder ratification of the appointment of Marcum LLP as our independent registered public accounting firm. The audit committee has submitted the selection of Marcum LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders do not ratify the appointment, the audit committee may reconsider its selection. Notwithstanding the proposed ratification of the selection of Marcum LLP by the stockholders, the audit committee, in its discretion, may direct the appointment of a new independent registered public accounting firm at any time during the year without notice to, or the consent of, the stockholders, if the audit committee determines that such a change would be in our best interests and the best interests of our stockholders.

Vote Required

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the reconvened annual meeting will be required to ratify the appointment of Marcum LLP as our independent registered public accounting firm for fiscal 2021. If the stockholders do not ratify the appointment of Marcum LLP, the audit committee may reconsider its selection, but is not required to do so. Notwithstanding the proposed ratification of the appointment of Marcum LLP by our stockholders, the audit committee, in its discretion, may direct the appointment of new independent auditors at any time during the year without notice to, or the consent of, the stockholders, if the audit committee determines that such a change would be in the best interests of our Company and our stockholders.

Principal Accountant Fees and Services

The following table presents the aggregate fees billed by Marcum LLP for the years ended December 31, 2020 and 2019:

| 2020 | 2019 | |||||||

| Audit Fees(1) | $ | 284,505 | $ | 364,620 | ||||

| Audit-Related Fees(2) | $ | — | $ | 31,930 | ||||

| Tax Fees(3) | $ | — | $ | — | ||||

| All Other Fees(4) | $ | — | $ | — | ||||

| Total Fees | $ | 284,505 | $ | 396,555 | ||||

| (1) | Audit Fees consist of fees for professional services rendered for the audit of our consolidated annual financial statements and review of the interim consolidated financial statements included in quarterly reports and services that are normally provided in connection with statutory and regulatory filings or engagements. |

| (2) | Audit-Related Fees consist principally of assurance and related services that are reasonably related to the performance of the audit or review of the Company’s financial statements but not reported under the caption Audit Fees above. These services include attest services that are not required by statute or regulation and consultations concerning financial accounting and reporting standards. |

| (3) | Tax Fees typically consist of fees for tax compliance, tax advice, and tax planning. |

| (4) | All Other Fees typically consist of fees for permitted non-audit products and services provided. |

10

The audit committee of our Board of Directors reviewed the services provided by Marcum LLP during the 2020 fiscal year and the fees billed for such services. After consideration, the audit committee determined that the receipt of these fees by Marcum LLP was compatible with the provision of independent audit services. The audit committee discussed these services and fees with Marcum LLP and our management to determine that they are permitted under the rules and regulations concerning auditor independence promulgated by the SEC to implement the Sarbanes-Oxley Act of 2002, as well as the American Institute of Certified Public Accountants.

Pre-Approval Policy

The audit committee has and will pre-approve all auditing services and permitted non-audit services to be performed for us by our auditors, including the fees and terms thereof (subject to the de minimis exceptions for non-audit services described in the Securities Exchange Act of 1934, as amended, which are approved by the audit committee prior to the completion of the audit).

The Board recommends that you vote “FOR” the ratification of the selection of Marcum LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2021.

| By Order of the Board of Directors | |

| /s/ Libing (Claire) Wu | |

| Libing (Claire) Wu | |

| Chief Executive Officer |

11