How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of November 13, 2024. Stockholders may not cumulate votes in the election of directors.

If I am a stockholder of record and I do not vote, or if I return a WHITE proxy card or otherwise vote without giving specific voting instructions, what happens?

If you are a stockholder of record and do not vote by completing your proxy card, through the internet or by voting electronically at the Annual Meeting, your shares will not be voted.

If you return a signed and dated WHITE proxy card or otherwise vote without marking voting selections, your shares will be voted in accordance with the recommendation of the Board on all matters presented in this proxy statement. If you vote via the Internet using the website noted on your proxy card, you do not need to return your proxy card.

If I am a beneficial owner of shares held in street name and I do not provide my broker or bank with voting instructions, what happens?

If you are a beneficial owner whose shares of record are held by a bank, broker or other nominee (sometimes called “street name” or “nominee name”) as of the record date, you may instruct your bank, broker or other nominee how to vote your shares. If you do not give instructions to your bank, broker or other nominee, the bank, broker or other nominee will determine if it has the discretionary authority to vote on the particular matter. Under the rules of the New York Stock Exchange (“NYSE”), which are also applicable to Nasdaq-listed companies (the “Broker Rules”), banks, brokers or other nominees have the discretion to vote on routine matters, but do not have the discretion to vote on non-routine matters.

Because the Annual Meeting is the subject of a contested solicitation, to the extent Knighted delivers its proxy materials to a broker who holds shares for a given stockholder, none of the matters to be voted on at the Annual Meeting will be considered a discretionary matter under the Broker Rules, and therefore, all of the matters to be voted at the Annual Meeting will be considered “non-routine”. In that case, if you hold your shares in the name of your bank, broker or other nominee that is subject to the Broker Rules, and you do not provide your bank, broker or other nominee with specific instructions regarding how to vote on a proposal to be voted on at the Annual Meeting, your bank, broker or other nominee will not be permitted to vote your shares on that proposal.

Street name stockholders should generally be able to vote by Internet or by signing, dating and returning a voting instruction form. Your broker is required to vote those shares in accordance with your instructions. However, the availability of Internet voting will depend on the voting process of your broker, bank or other nominee. If you are a street name stockholder, then you may not vote your shares by ballot at the Annual Meeting unless you obtain a legal proxy from your broker, bank or other nominee.

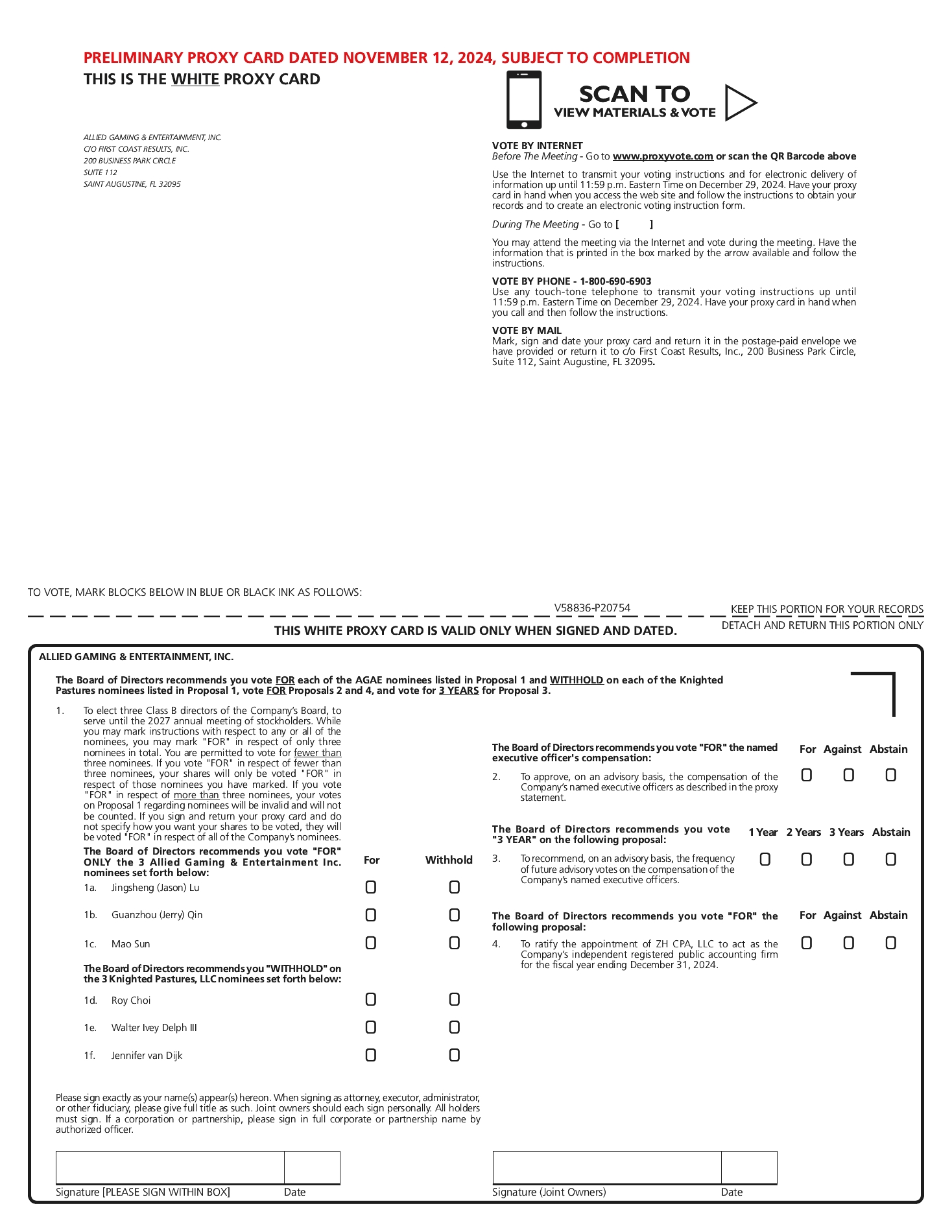

What happens if I return a WHITE proxy card but give voting instructions for more than three nominees?

If you are a stockholder of record and you vote “FOR” more than three nominees on your WHITE proxy card, your votes on Proposal 1 for the election of directors will be invalid and will not be counted. If you are a beneficial holder and you vote “FOR” more than three nominees on your WHITE voting instruction form, your votes on Proposal 1 for the election of directors will be invalid and will not be counted.

What happens if I return a WHITE proxy card but give voting instructions for less than three nominees?

If you are a stockholder of record and you vote “FOR” with respect to fewer than three nominees on your WHITE proxy card, your shares will only be voted “FOR” those nominees you have so marked. If you are a beneficial holder and you vote “FOR” with respect to fewer than three nominees on your WHITE voting instruction form, your shares will only be voted “FOR” those nominees you have so marked.

Will there be a proxy contest at the Annual Meeting?

Yes. We have received notice from Knighted, which owns along with its affiliates approximately 27.2% of our common stock, expressing the intention of Knighted to nominate three director candidates for election to our Board of Directors at the Annual Meeting at which three Class B directors are to be elected. The presence of the Knighted Nominees on the enclosed WHITE proxy card is NOT an endorsement or approval of, or comment on, the fitness, character, suitability or other qualifications of the Knighted Nominees.