Exhibit 99.1

Allied Gaming & Entertainment Announces Fourth Quarter and Full Year 2023 Financial Results

New York, NY (March 27, 2024) – Allied Gaming & Entertainment, Inc. (NASDAQ: AGAE) (the “Company” or “AGAE”), a global experiential entertainment company, today announced financial results for the fourth quarter and full year

ended December 31, 2023.

“We made substantial progress during fiscal year 2023 and have entered fiscal year 2024 in a position of strength. Allied Esports International (“AEI”), Allied Mobile

Entertainment (“AME”), and Allied Experiential Entertainment (“AEE”) are all poised for growth as we execute on our strategic objectives this year,” said Yinghua Chen, the Company’s Chief Executive Officer. “With Beijing Lianzhong Zhihe Technology

Co. (“Z-Tech”) now integrated into our business, AEE finalizing events and expanding its presence in Asia and the continued demand we have for our AEI properties and content, we are extremely excited for the year ahead and very confident in our path

forward.”

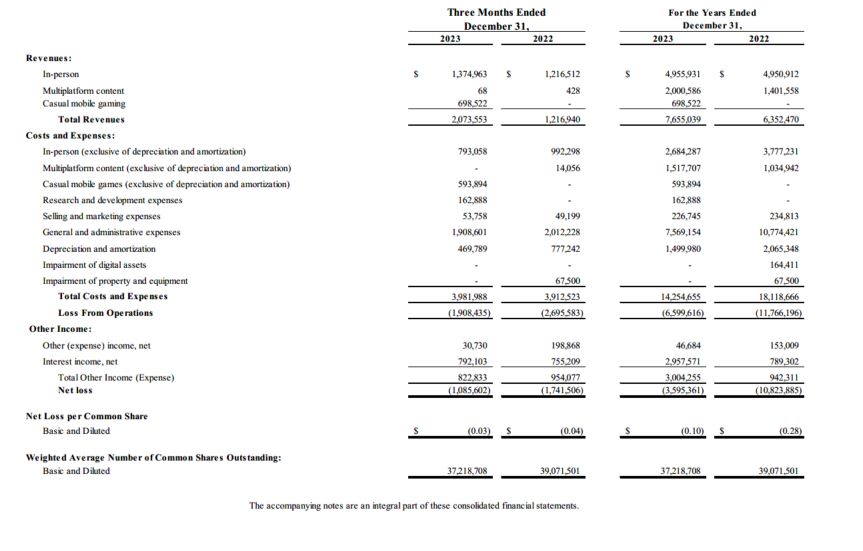

Full Year 2023 Financial Results

Revenues: Total revenues of $7.7 million increased 21% in 2023 compared to 2022. The increase in revenue year-over-year was primarily driven by an increase in

sponsorship revenue relating to the renewal of our naming rights agreement for our flagship esports facility, HyperX Arena Las Vegas, Season Two of Elevated and two months of revenue from our recent October 2023 strategic investment in Z-Tech.

Costs and expenses: Total costs and expenses were $14.3 million in 2023, a decrease of 21% compared to 2022. The net decrease in costs and expenses of $3.9 million is

primarily due to a $3.2 million, or 30% reduction in general and administrative expenses, consisting principally of a $1.5 million Employee Retention Credit recognized in 2023, stock-based compensation of $0.9 million, payroll and payroll-related

costs of $0.8 million, and insurance and rent expenses of $0.2 million each. These decreases were partially offset by a $0.4 million increase in legal and professional fees related to normal business matters as well as the strategic investment in

Z-Tech and other strategic investment opportunities.

Net loss (including the amount attributable to non-controlling interests) was $3.6 million in 2023 compared to a net loss of $10.8 million in 2022.

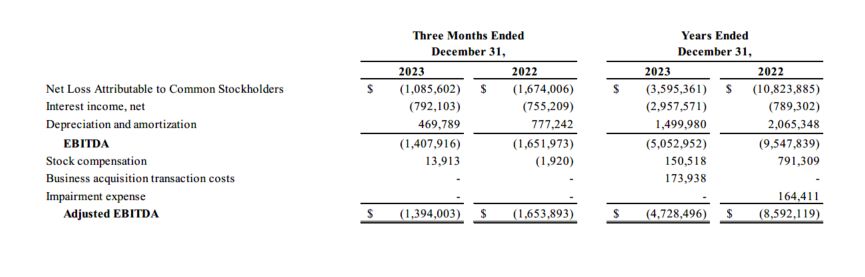

Adjusted EBITDA loss was $4.6 million for 2023 compared to a loss of $8.6 million in 2022. A reconciliation of the GAAP-basis net loss to adjusted EBITDA is provided

in the table at the end of this press release.

Fourth Quarter 2023 Financial Results

Revenues: Total revenues of $2.1 million increased 70% for the fourth quarter of 2023 compared to the fourth quarter of 2022. The increase from the fourth quarter of

2022 was driven by an increase in HyperX sponsorship revenues and two months of Z-Tech operations.

Costs and expenses: Total costs and expenses for the fourth quarter of 2023 were $4.0 million, a slight increase of 2% compared to the fourth quarter of 2022.

Net loss (including the amount attributable to non-controlling interests) was $1.1 million in the fourth quarter of 2023 compared to a net loss of $1.7 million in the

fourth quarter of 2022.

Adjusted EBITDA loss was $1.2 million for the fourth quarter of 2023 compared to a loss of $1.7 million in the fourth quarter of 2022. A reconciliation of the

GAAP-basis net loss to adjusted EBITDA is provided in the table at the end of this press release.

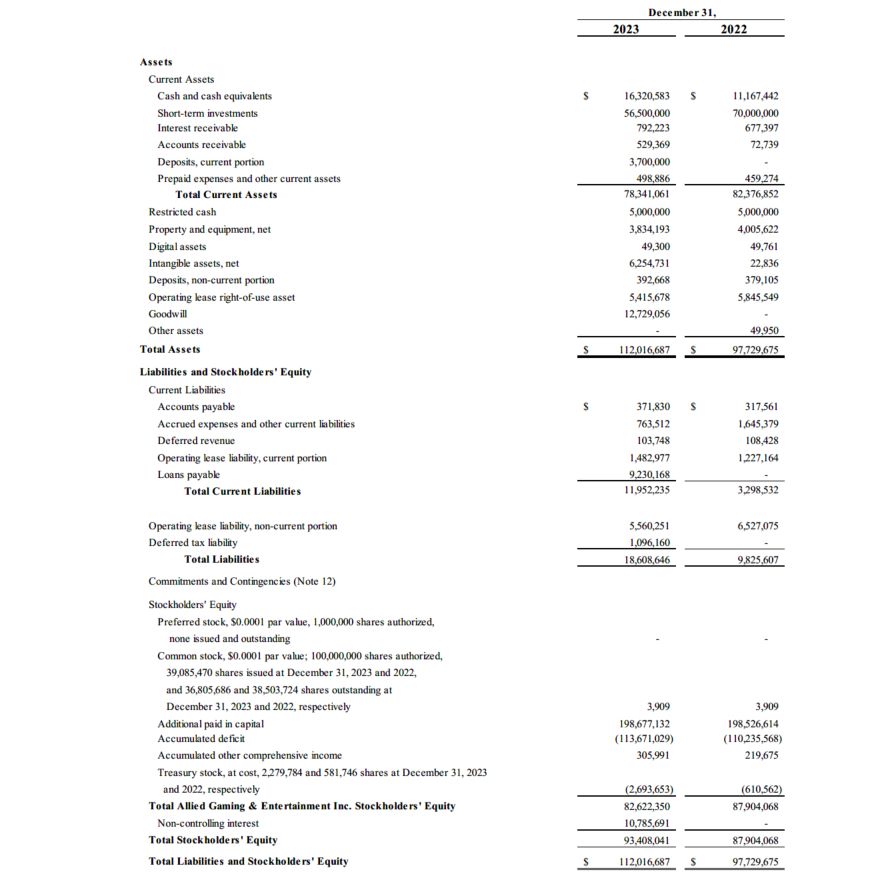

Balance Sheet

As of December 31, 2023, the Company had a cash and short-term investments position of $78.6 million, including $5.0 million of restricted cash. This compared to $86.8

million in cash and short-term investments on December 31, 2022, which also included $5.0 million of restricted cash. At December 31, 2023, the Company had a working capital position of $66.4 million compared to $79.1 million at December 31, 2022. As of December 31, 2023, the Company had 36.8 million shares of outstanding common stock, including 2.3 million shares repurchased under the Company’s 2022 Stock Repurchase

Plan.

Operational Update

Allied Esports produced 64 events in the fourth quarter of 2023, with 30 proprietary

events and 34 third-party events. Third-party events were highlighted by Omen Showcase Party; World Esports Day – TwitchCon Afterparty; EA Sports F1 23 Las Vegas Showrun; and All MLB Team Awards Show.

In November, AGAE closed on its strategic investment in Z-Tech, a prominent developer and operator of casual mobile games. As of October 31, 2023, AGAE has assumed a

controlling interest in the Board for purpose of financial statement consolidation and became the largest shareholder of Z-Tech.

In December, Elite Fun Entertainment Co. Ltd., a premier player in the Greater Bay Area cultural and entertainment industry, agreed to a strategic investment in AGAE.

The partnership marks the beginning of a dynamic collocation aimed at maximizing mutual benefits for expanding in the burgeoning market of live entertainment in Asia.

Also in December, AGAE announced the formation of Skyline Music Entertainment, a joint venture based in Macau that is poised to capitalize on the entertainment

industry in the Asia market. AGAE’s wholly owned subsidiary, Allied Experiential Entertainment, Inc., owns 51% of Skyline Music Entertainment.

Fourth Quarter and Full Year 2023 Conference Call

The Company will host a conference call today at 2:00 p.m. Pacific Time / 5:00 p.m. Eastern Time to discuss its fourth quarter and full year 2023 financial results.

Participants may join the conference call by dialing 1-877-407-0792 (United States) or 1-201-689-8263 (International).

A live webcast of the conference call will also be available on Allied Gaming & Entertainment’s Investor Relations site here. Additionally, financial information presented on the call will be available on Allied Gaming & Entertainment’s Investor Relations site. For those unable to participate in the

conference call, a telephonic replay of the call will also be available shortly after the completion of the call, until 11:59 p.m. ET on Wednesday, April 10, 2024, by dialing 1-844-512-2921 (United States) or 1-412-317-6671 (International) and using

the replay passcode: 13744532.

About Allied Gaming & Entertainment

Allied Gaming & Entertainment Inc. (Nasdaq: AGAE) is a global experiential entertainment company focused on providing a growing world of gamers with unique

experiences through renowned assets, products and services. For more information, visit alliedgaming.gg.

Non-GAAP Financial Measures

As a supplement to our financial measures presented in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”), the Company presents certain non-GAAP

measures of financial performance. These non-GAAP financial measures are not intended to be considered in isolation from, as a substitute for, or as more important than, the financial information prepared and presented in accordance with GAAP. In

addition, these non-GAAP measures have limitations in that they do not reflect all of the items associated with the company’s results of operations as determined in accordance with GAAP. Non-GAAP financial measures are not an alternative to the

Company’s GAAP financial results and may not be calculated in the same manner as similar measures presented by other companies.

The Company provides net income (loss) and earnings (loss) per share in accordance with GAAP. In addition, the Company provides EBITDA (defined as GAAP net income

(loss) from continuing operations before interest (income) expense, income taxes, depreciation, and amortization). The Company defines “Adjusted EBITDA” as EBITDA excluding certain non-cash and non-recurring charges, such as stock-based compensation,

business acquisition transaction costs and impairment expense.

In the future, the Company may also consider whether other items should also be excluded in calculating the non-GAAP financial measures used by the Company. Management

believes that the presentation of these non-GAAP financial measures provides investors with additional useful information to measure the Company’s financial and operating performance. In particular, these measures facilitate comparison of our

operating performance between periods and help investors to better understand the operating results of the Company by excluding certain items that may not be indicative of the Company’s core business, operating results, or future outlook.

Additionally, we consider quantitative and qualitative factors in assessing whether to adjust for the impact of items that may be significant or that could affect an understanding of our ongoing

financial and business performance or trends. Internally, management uses these non-GAAP financial measures, along with others, in assessing the Company’s operating

results, measuring compliance with any applicable requirements of the Company’s debt financing agreements in place at such time, as well as in planning and forecasting.

The Company’s non-GAAP financial measures are not based on a comprehensive set of accounting rules or principles, and our non-GAAP definitions of the “EBITDA” and

“Adjusted EBITDA” do not have a standardized meaning. Therefore, other companies may use the same or similarly named measures, but include or exclude different items, which may not provide investors a comparable view of the Company’s performance in

relation to other companies.

Management compensates for the limitations resulting from the exclusion of these items by considering the impact of the items separately and by considering the

Company’s GAAP, as well as non-GAAP, financial results and outlook, and by presenting the most comparable GAAP measures directly ahead of non-GAAP measures, and by providing a reconciliation that indicates and describes the adjustments made.

Forward Looking Statements

This communication contains certain forward-looking statements under federal securities laws. Forward-looking statements may include our statements

regarding our goals, beliefs, strategies, objectives, plans, including product and service developments, future financial conditions, results or projections or current expectations. In some cases, you can identify forward-looking statements by

terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “intend” or “continue,” the negative of such terms, or other comparable terminology. These statements are subject to known and

unknown risks, uncertainties, assumptions and other factors that may cause actual results to be materially different from those contemplated by the forward-looking statements. These forward-looking statements are not guarantees of future performance,

conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside our control, that could cause actual results or outcomes to differ materially from those

discussed in these forward-looking statements. The inclusion of such information should not be regarded as a representation by the Company, or any person, that the objectives of the Company will be achieved. Important factors, among others, that may

affect actual results or outcomes include: risks associated with the future direction or governance of the Company; our ability to execute on our strategic and business plans; the substantial uncertainties inherent in the acceptance of existing and

future products and services; the ability to retain key personnel; potential litigation; general economic and market conditions impacting demand for our services; our inability to enter into one or more future acquisition or strategic transactions;

and our ability, or a decision not to pursue strategic options for the esports business. You should consider the areas of risk described in connection with any forward-looking statements that may be made herein. The business and operations of AGAE

are subject to substantial risks, which increase the uncertainty inherent in the forward-looking statements contained in this communication. Except as required by law, we undertake no obligation to release publicly the result of any revision to these

forward-looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of

unanticipated events. Further information on potential factors that could affect our business and results is described under “Item 1A. Risk Factors” in

our Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the SEC on March 27, 2024, as amended, as well as subsequent reports we file with the SEC. Readers are also urged to carefully review and consider the various

disclosures we made in such Annual Report on Form 10-K and in subsequent reports with the SEC.

# # #

Investor Contact:

Tyler Drew

Addo Investor Relations

agae@addo.com

310-829-5400

Allied Gaming & Entertainment, Inc. and Subsidiaries

Consolidated Balance Sheets

Allied Gaming & Entertainment, Inc. and Subsidiaries

Consolidated Statements of Operations

Allied Gaming & Entertainment, Inc. and Subsidiaries

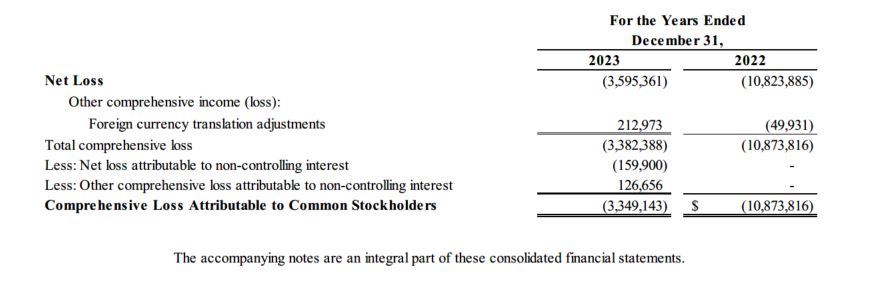

Consolidated Statements of Comprehensive Loss

Non-GAAP Financial Measures

EBITDA and Adjusted EBITDA are non-GAAP financial measures and should not be considered as a substitute for net income (loss), operating income (loss) or

any other performance measure derived in accordance with United States generally accepted accounting principles (“GAAP”) or as an alternative to net cash provided by operating activities as a measure of AGAE’s profitability or liquidity. AGAE’s

management believes EBITDA and Adjusted EBITDA are useful because they allow external users of its financial statements, such as industry analysts, investors, lenders and rating agencies, to more effectively evaluate its operating performance,

compare the results of its operations from period to period and against AGAE’s peers without regard to AGAE’s financing methods, hedging positions or capital structure and because it highlights trends in AGAE’s business that may not otherwise be

apparent when relying solely on GAAP measures. AGAE presents EBITDA and Adjusted EBITDA because it believes EBITDA and Adjusted EBITDA are important supplemental measures of its performance that are frequently used by others in evaluating companies

in its industry. Because EBITDA and Adjusted EBITDA exclude some, but not all, items that affect net income (loss) and may vary among companies, the EBITDA and Adjusted EBITDA AGAE presents may not be comparable to similarly titled measures of other

companies. AGAE defines EBITDA as earnings before interest, income taxes, depreciation and amortization of intangibles. AGAE defines Adjusted EBITDA as EBITDA excluding stock-based compensation, business acquisition costs and impairment expense.